Introduction

A customer switches tools after six months and describes the reason in a single sentence: another product felt easier and clearer from day one. Moments like this reveal how deeply competitive context shapes product success. Teams that understand their landscape make sharper decisions about positioning, features, and user experience. Competitive analysis for product managers provides the structured insight needed to identify strengths, gaps, and emerging expectations across the market. This guide outlines a practical approach to conducting competitive analysis in product management, transforming scattered observations into meaningful product direction.

What does competitive analysis mean in product management?

Before selecting frameworks or building comparison sheets, product teams need a shared understanding of what competitive analysis actually means in product management. A clear foundation helps teams avoid shallow comparisons and focus on insights that influence real product decisions.

What is competitive analysis?

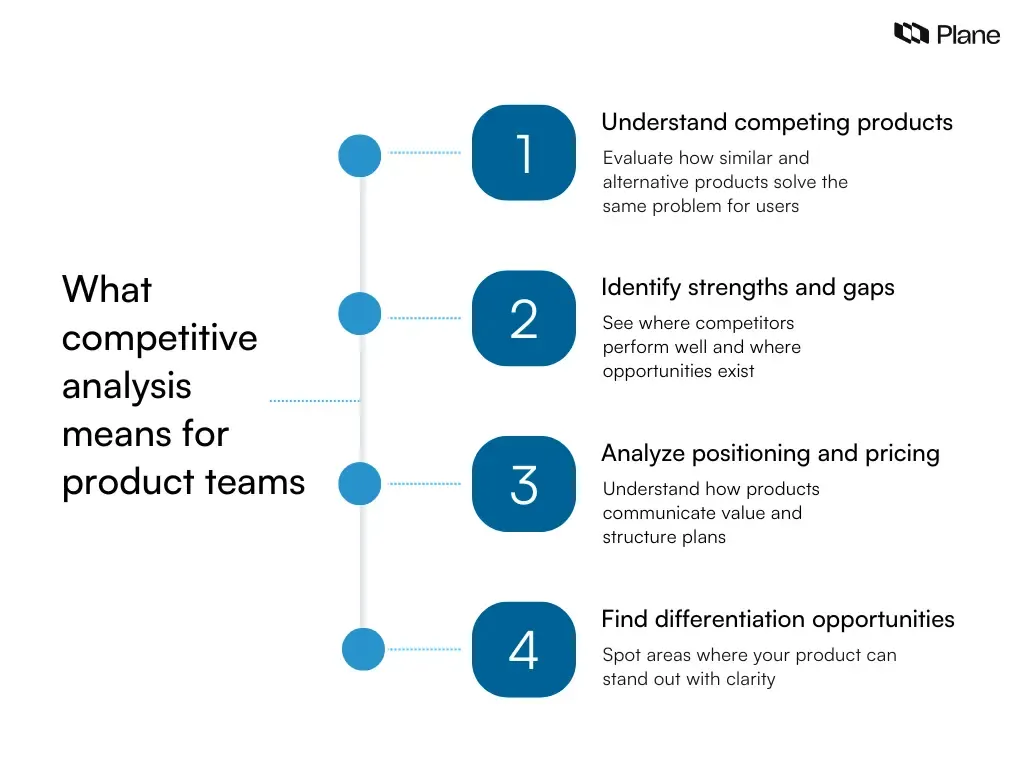

Competitive analysis in product management is a structured evaluation of competing and alternative products to understand how they solve similar problems, where they perform well, and where gaps exist in the market. It looks at product capabilities, positioning, pricing, user experience, and customer perception to create a complete picture of the competitive landscape.

A strong competitive analysis for product managers focuses on three core questions:

- What problems do competing products solve, and for whom

- Where do competitors perform strongly or fall short

- What opportunities exist for meaningful differentiation

This process helps teams move beyond assumptions and base product strategy on a clear market context. Instead of reacting to isolated feature launches, teams gain a broader understanding of category expectations and emerging patterns. Over time, competitive analysis becomes a reliable input for roadmap planning, positioning, and long-term product direction.

Competitive analysis vs. competitor research vs. market research

These terms are often used interchangeably, yet each serves a different purpose. Understanding the distinction helps teams apply the right type of analysis at the right time.

Area | Focus | Key purpose | How product teams use it |

Competitor research | Individual competitors and their activities | Gather basic information about specific competitors | Track launches, features, pricing updates, and announcements |

Market research | Market size, trends, and customer behavior | Understand demand, segments, and overall market direction | Validate opportunities and identify target segments |

Competitive analysis in product management | Comparative evaluation of products and positioning | Identify strengths, gaps, differentiation, and risks | Inform roadmap decisions, positioning, and product strategy |

Competitor research collects raw information. Market research explains the broader landscape. Competitive analysis connects both and translates insights into product decisions. This connection makes competitive analysis a core discipline for product managers rather than a side activity.

Why competitive analysis is not about copying competitors

Competitive analysis for product managers supports differentiation rather than imitation. Copying competitor features without understanding context often leads to feature-heavy products that lack clarity and direction. Strong product teams use competitive insights to identify patterns and expectations, then decide where to align and where to stand apart.

A structured competitive analysis helps teams:

- Understand table-stakes capabilities expected by users

- Identify gaps that competitors have overlooked

- Recognize strengths worth countering or differentiating from

- Spot shifts in positioning, pricing, or user experience

Instead of chasing feature parity, teams gain clarity on where they can create meaningful value. Competitive analysis in product management works best when it supports confident decision-making and sharper positioning rather than reactive development.

Why competitive analysis is important for product managers

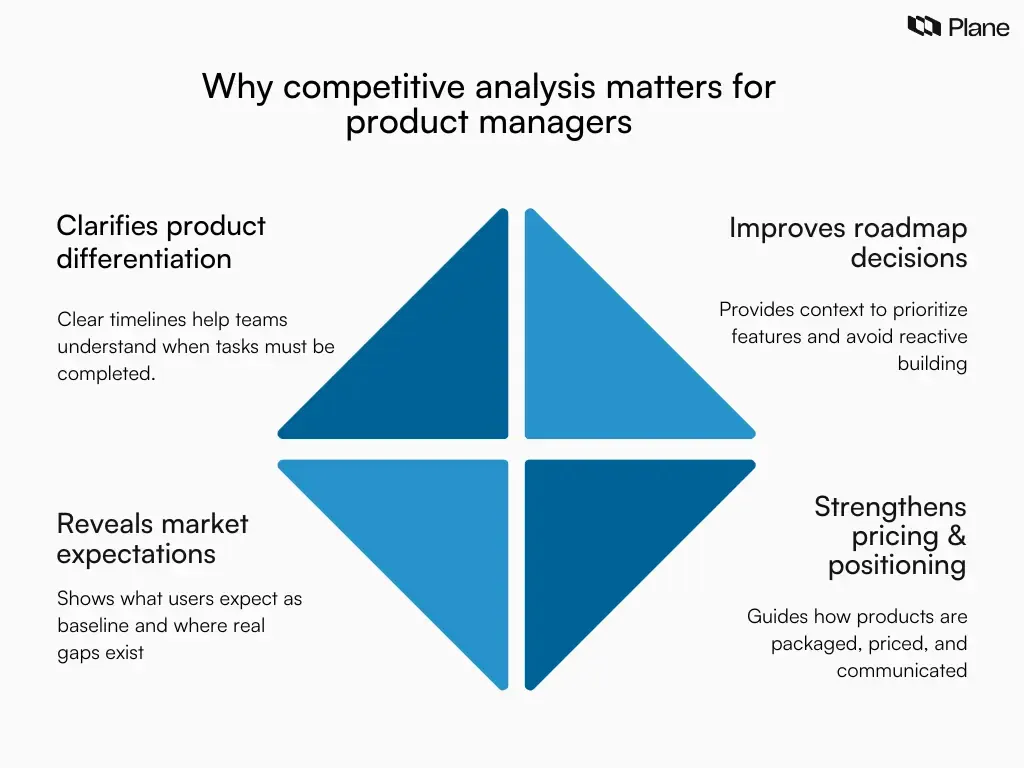

Competitive analysis plays a direct role in everyday product work. It shapes how product managers prioritize features, position the product, and respond to market shifts with clarity. A strong competitive analysis for product managers helps teams understand where they stand, what users expect, and where meaningful opportunities exist.

Let's break down how competitive analysis supports positioning, roadmap decisions, market understanding, and go-to-market clarity for product teams.

1. Helps teams identify differentiation and positioning

Most products address similar problems, so users prioritize clarity, usability, trust, and value over features. Competitive analysis helps product managers understand competitor positioning and user perceptions. By reviewing messaging, onboarding, features, and feedback, teams can identify unique strengths, refine positioning, and avoid generic value propositions, focusing on what matters most to users. Clear differentiation makes marketing sharper, sales conversations easier, and product decisions more intentional.

2. Improves product strategy and roadmap decisions

Product roadmaps often get swayed by competitor launches and market noise. Competitive analysis helps teams assess if a competitor's move truly impacts their users and strategy. Understanding what and why competitors build allows product managers to prioritize effectively, distinguish essential features from those misaligned with their product’s direction, and focus on long-term goals rather than reactive decisions. Over time, consistent competitive analysis leads to informed, deliberate roadmap decisions aligned with product goals.

3. Reveals market expectations and gaps

Every category develops baseline expectations. Users assume certain workflows, integrations, or usability standards will exist. Competitive analysis helps product managers identify these table-stakes capabilities and ensure the product meets essential expectations. At the same time, it reveals gaps competitors have overlooked. These gaps often appear in usability, onboarding clarity, workflow flexibility, or pricing transparency. Identifying such opportunities allows teams to deliver meaningful improvements rather than incremental parity.

Understanding both expectations and gaps enables teams to build products that feel complete while still offering clear differentiation.

4. Supports better pricing, messaging, and launches

Competitive insights influence more than feature decisions. They shape pricing strategy, packaging structure, and product messaging. By analyzing competitor pricing tiers, value metrics, and positioning language, teams gain a clearer understanding of how value is communicated across the market. This context helps product managers and go-to-market teams launch features with stronger messaging and realistic pricing. It also supports clearer communication of what makes the product valuable for its target users.

When competitive analysis becomes a regular practice, product teams can align product strategy, positioning, and go-to-market decisions with confidence.

When product managers should run competitive analysis

Competitive analysis in product management works best as a recurring practice rather than a one-time exercise. Market expectations, pricing models, and product positioning shift constantly, and product teams need the current context to make confident decisions. The following situations highlight when competitive analysis provides the most value for product managers and product teams.

1. Before building or launching a new feature

Before committing to a new feature, product managers need to understand how similar problems are already being solved across the market. Competitive analysis helps validate whether the problem has existing solutions and how those solutions approach it.

Reviewing competitor workflows, limitations, and user feedback reveals where current products fall short. This insight helps teams avoid building redundant capabilities and instead focus on improvements that create clear value. It also highlights user expectations around usability, integrations, and performance that may influence adoption after launch.

2. When entering a new market or segment

Expanding into a new segment introduces different expectations, pricing sensitivities, and workflow preferences. Competitive analysis for product managers helps teams understand which products already serve that segment and how they position themselves.

By studying competitor messaging, feature emphasis, and customer feedback, teams gain clarity on what matters most to that audience. This understanding supports stronger positioning, realistic pricing decisions, and a clearer roadmap for entering the new segment with confidence.

3. During product repositioning or pricing changes

Repositioning a product or adjusting pricing requires careful evaluation of how competitors communicate value. Competitive analysis in product management helps teams understand how similar products structure pricing tiers, highlight differentiators, and justify cost.

This context supports more informed decisions about packaging, feature distribution across tiers, and messaging clarity. It also reduces the risk of pricing changes that create confusion or weaken perceived value in the market.

4. As an ongoing product strategy habit

Competitive analysis delivers the most value when treated as a continuous product strategy habit. Markets evolve as competitors ship new features, refine positioning, and adjust pricing. Regular reviews help product managers stay aware of these shifts without reacting impulsively to every update.

Maintaining lightweight, ongoing competitive analysis ensures that insights remain current and accessible. Over time, this practice supports clearer roadmap planning, stronger positioning, and more confident product decisions across the organization.

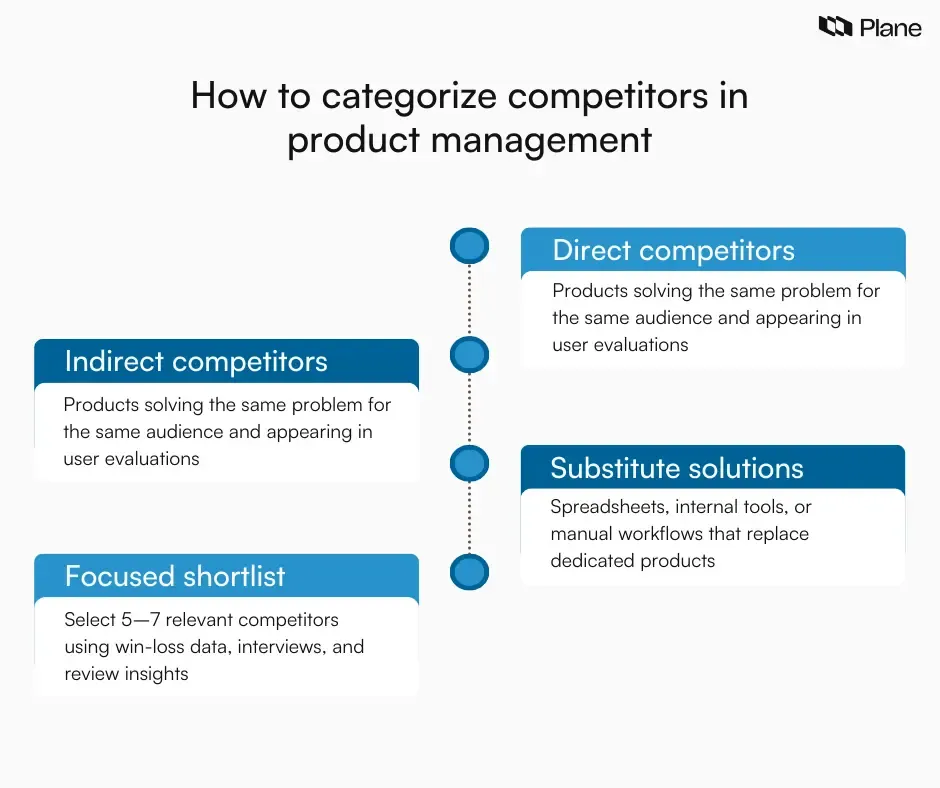

Identify and categorize your competitors correctly

Many teams run competitive analysis on the wrong set of products. They either study only well-known brands or track every tool in the category without clear relevance. Effective competitive analysis for product managers starts with identifying the competitors that actually influence user decisions.

The following categories help product managers identify which competitors to track and why they matter.

1. Direct competitors

Direct competitors solve the same core problem for the same audience. They often appear in customer evaluations, comparison searches, and sales conversations. These are the products users actively compare before making a decision.

To identify direct competitors, review:

- Win and loss notes from sales or user interviews

- Comparison of keywords users search for

- Review platforms where users evaluate similar tools

Direct competitors should be the focus of any competitive analysis in product management, as they most strongly influence positioning, pricing, and feature expectations.

2. Indirect competitors

Indirect competitors address the same outcome but through a different approach or workflow. They may target a slightly different audience or offer broader capabilities that overlap with your product’s use case.

For example, a project management tool may compete indirectly with collaboration platforms, documentation tools, or workflow automation products. Users may choose these alternatives to achieve similar outcomes through different methods.

Analyzing indirect competitors helps product managers understand how users evaluate solutions beyond traditional category boundaries. It also reveals emerging expectations and potential shifts in user behavior.

3. Substitute solutions and “do nothing” competitors

Some of the strongest competition comes from tools or workflows that replace the need for a dedicated product. These substitutes often include spreadsheets, internal dashboards, email threads, shared documents, or manual coordination processes.

In many cases, the real competitor is the existing workflow rather than another software product. Understanding why users continue with current methods helps product managers identify barriers to adoption and opportunities for simplification.

Including substitute solutions in competitive analysis provides a more realistic view of the market and highlights areas where the product must deliver clear value to drive change.

4. How to shortlist competitors for analysis

A focused shortlist keeps competitive analysis actionable. Reviewing too many competitors leads to shallow insights, while a targeted set allows deeper evaluation.

To build a practical shortlist:

- Analyze win and loss data to see which products appear most often

- Review customer interviews and onboarding feedback

- Check review platforms and comparison pages

- Monitor recurring competitor mentions in sales conversations

Select five to seven competitors across direct, indirect, and substitute categories. This range allows meaningful analysis without overwhelming the team. A well-defined shortlist ensures that competitive analysis in product management remains structured, relevant, and directly connected to product decisions.

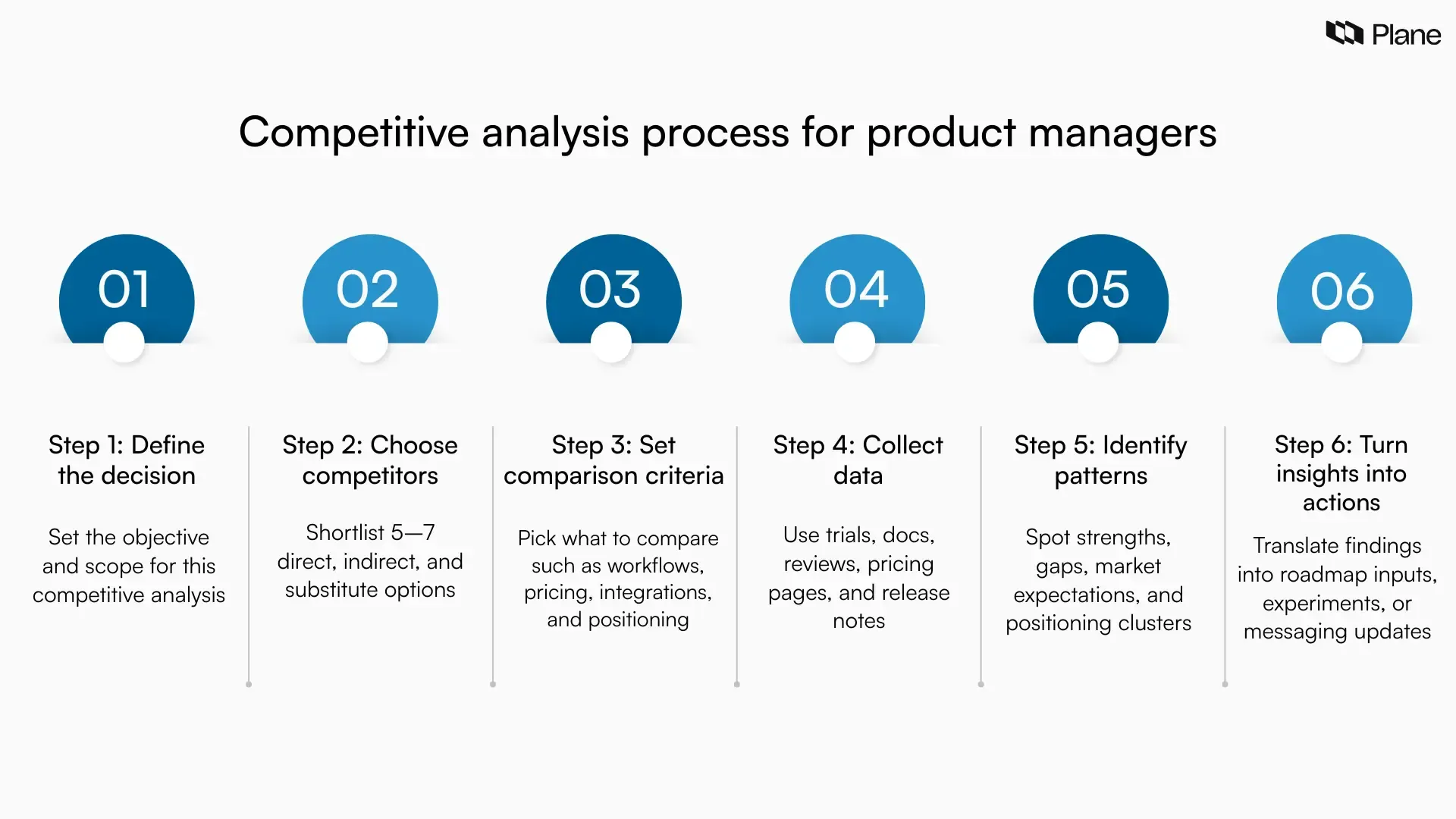

How to conduct competitive analysis: Step-by-step process

Competitive analysis in product management works best when it follows a clear system. Without structure, teams collect scattered information that rarely influences real decisions. With the right process, competitive analysis becomes a reliable input for roadmap planning, positioning, and strategy.

product's depth

The steps below outline a practical workflow product managers can use to run competitive analysis and turn insights into action.

Step 1: Define your objective and scope

Start with a clear reason for running the analysis. Every competitive analysis for product managers should support a specific decision, such as roadmap prioritization, positioning clarity, pricing updates, or feature validation.

Write down what you are trying to decide and set boundaries around what you will evaluate.

Focus on relevant workflows, features, pricing, or positioning rather than trying to analyze everything at once. A clear objective keeps the analysis focused and prevents unnecessary research.

Step 2: Choose competitors to analyze

Limit the number of competitors to keep the analysis meaningful. A set of five to seven competitors usually provides enough context without becoming overwhelming.

Include:

- Direct competitors that appear in user evaluations

- Indirect competitors offering alternative approaches

- Substitute solutions such as spreadsheets or internal workflows

Depth matters more than quantity. Studying a smaller set thoroughly yields deeper insights than scanning a long list superficially.

Step 3: decide comparison criteria

Before collecting data, define what you want to compare across competitors. Consistent criteria make the analysis easier to interpret and share.

Common evaluation areas include:

- Features and workflows

- Pricing and packaging

- Integrations and ecosystem

- Onboarding experience

- Positioning and messaging

Choose criteria based on your objective. For example, if the goal is adoption, focus more on onboarding and usability than on advanced features.

Step 4: Collect competitor data

Gather information from multiple reliable sources rather than relying on assumptions. Explore competitor websites, pricing pages, documentation, and product demos. Use free trials when possible to experience workflows directly.

Customer reviews and community discussions often reveal recurring strengths and pain points that product pages do not highlight. Release notes and changelogs also help identify where competitors are investing.

Collect information in a structured format so comparisons remain clear and consistent.

Step 5: Analyze patterns and insights

Once data is collected, focus on patterns rather than isolated details. Identify where competitors perform strongly, where they struggle, and what users consistently expect.

Look for:

- Table-stakes capabilities are present across most products

- Recurring user frustrations or limitations

- Gaps that competitors have not addressed

- Differences in positioning and target audience

These patterns help product managers understand both market expectations and opportunities.

Step 6: Translate insights into product decisions

Competitive analysis delivers value only when it informs action. Convert insights into clear product decisions or experiments.

Use findings to:

- Prioritize roadmap initiatives

- Refine positioning and messaging

- Adjust pricing or packaging

- Validate feature investments

- Identify differentiation opportunities

End each analysis with a short summary of recommended actions and open questions. This ensures the work directly supports product strategy rather than remaining a static document.

Competitive analysis frameworks product managers should know

Frameworks help product managers structure competitive analysis and extract clear insights from scattered information. They provide a consistent way to compare products, identify gaps, and communicate findings across teams. These frameworks work best as practical tools that support decisions rather than rigid methods that must be followed every time. The following frameworks support different competitive analysis goals. Choose based on what you want to understand or decide.

1. Feature comparison matrix

A feature comparison matrix is one of the most practical tools for competitive analysis in product management. It helps teams evaluate how products support key workflows and capabilities side by side.

Use this framework when:

- planning roadmap priorities

- evaluating feature gaps

- preparing for launches or upgrades

- supporting sales and positioning clarity

Focus on workflows instead of listing every feature. Compare how each product supports real use cases such as onboarding, reporting, integrations, or collaboration. This approach highlights strengths, limitations, and areas for differentiation.

A well-structured matrix makes it easier for teams to see where parity exists and where meaningful improvements can create value.

2. SWOT analysis

SWOT analysis provides a quick snapshot of each competitor’s strengths, weaknesses, opportunities, and threats. It helps product managers summarize findings from broader research into a simple and shareable format.

Use this framework when:

- presenting insights to leadership or stakeholders

- reviewing the competitive landscape at a high level

- evaluating risks and opportunities before major decisions

Strengths and weaknesses focus on product capabilities, usability, pricing, and positioning. Opportunities and threats reflect market shifts, emerging needs, and competitive moves. This format helps teams quickly align on where they stand and what to monitor.

3. Positioning or perceptual mapping

Positioning maps help teams understand how competitors are perceived in the market. They visually position products along two meaningful axes, such as simplicity vs. flexibility, affordability vs. enterprise depth, or speed vs. customization.

Use this framework when:

- Refining product positioning

- Entering a new market segment

- Preparing messaging for launches or campaigns

- Identifying differentiation opportunities

Plotting competitors visually reveals clusters and open spaces in the market. It becomes easier to identify whether your product overlaps heavily with existing players or occupies a distinct position. This clarity supports stronger messaging and more intentional positioning decisions.

4. Porter’s five forces

Porter’s Five Forces help product managers understand broader market pressures and competitive intensity. It looks beyond individual competitors and examines how the overall environment shapes strategy.

Use this framework when:

- Evaluating a new market or category

- Assessing long-term strategic risks

- Analyzing pricing pressure or supplier dependency

- Preparing for expansion or investment decisions

This framework examines competitive rivalry, threat of new entrants, substitute solutions, buyer power, and supplier power. It provides a macro view of the environment and helps teams anticipate shifts that may influence product strategy over time.

5. Customer journey comparison

Customer journey comparison focuses on the end-to-end user experience across competing products. It evaluates how easily users can discover value, complete tasks, and achieve outcomes.

Use this framework when:

- Improving onboarding and activation

- Reducing friction in key workflows

- Evaluating usability against competitors

- Understanding switching behavior

Compare steps such as signup, setup, first task completion, collaboration, and reporting. Capture friction points, guidance clarity, and time-to-value. This approach highlights where competitors simplify workflows and where users encounter complexity.

Comparing customer journeys helps product managers identify improvements that directly impact adoption and satisfaction, rather than focusing only on feature parity.

Where to collect competitor insights and data

Strong competitive analysis in product management depends on reliable inputs. Many teams rely solely on competitors' homepages, which rarely reflect the product's depth or the user experience. The sources below help product teams gather accurate insights without overcomplicating the process.

1. Product websites and help centers

Competitor websites provide a clear view of positioning, target audience, and core messaging. They show how each product communicates value and which problems it claims to solve.

Help centers and documentation reveal actual product depth. They explain workflows, limitations, permissions, and configuration options that marketing pages often simplify. Reviewing documentation helps product managers understand how features work in practice and whether capabilities match positioning.

Use these sources to capture:

- Key use cases and workflows

- Feature structure and depth

- Positioning language and claims

- Target audience and segment focus

2. Product demos and free trials

Hands-on experience provides insights that screenshots and feature lists cannot. Signing up for free trials or watching guided demos helps product managers understand the onboarding flow, navigation, and real workflow execution.

Focus on completing one or two core workflows instead of exploring everything. Observe how quickly value becomes visible, where friction appears, and how clearly the product guides new users. Capture screenshots and notes while testing to make comparisons easier later.

Direct product experience often reveals usability strengths and gaps that are difficult to identify through documentation alone.

3. Customer reviews and community discussions

Customer reviews and community discussions offer unfiltered insight into user perception. They highlight recurring frustrations, appreciated capabilities, and reasons users switch products.

Look for patterns instead of isolated opinions. Repeated comments about performance issues, usability challenges, or strong support experiences provide useful signals. Community forums, social platforms, and professional networks also reveal how users discuss products in real situations. These insights help product managers understand emotional drivers behind adoption and churn, which feature lists alone cannot explain.

4. Pricing pages and packaging

Pricing pages reveal how competitors structure value and monetize usage. Review pricing tiers, limits, and feature distribution across plans to understand who each product targets and how it positions itself.

Pay attention to:

- Value metrics such as per user, per project, or usage-based pricing

- Features are restricted to higher tiers

- Free plan limitations and trial structure

- Messaging around value and differentiation

Pricing and packaging insights help product managers evaluate whether their own pricing aligns with the segment they serve and the value they deliver.

5. Release notes and changelogs

Release notes and changelogs show where competitors are investing and how quickly they evolve. They reveal patterns in feature development, integrations, performance improvements, and strategic direction.

Tracking updates over time helps product managers understand momentum and emerging priorities. A competitor consistently releasing automation or reporting updates signals a strong investment area. Frequent usability improvements may indicate a focus on adoption and retention.

Reviewing changelogs periodically keeps competitive analysis current and helps teams anticipate shifts in the competitive landscape.

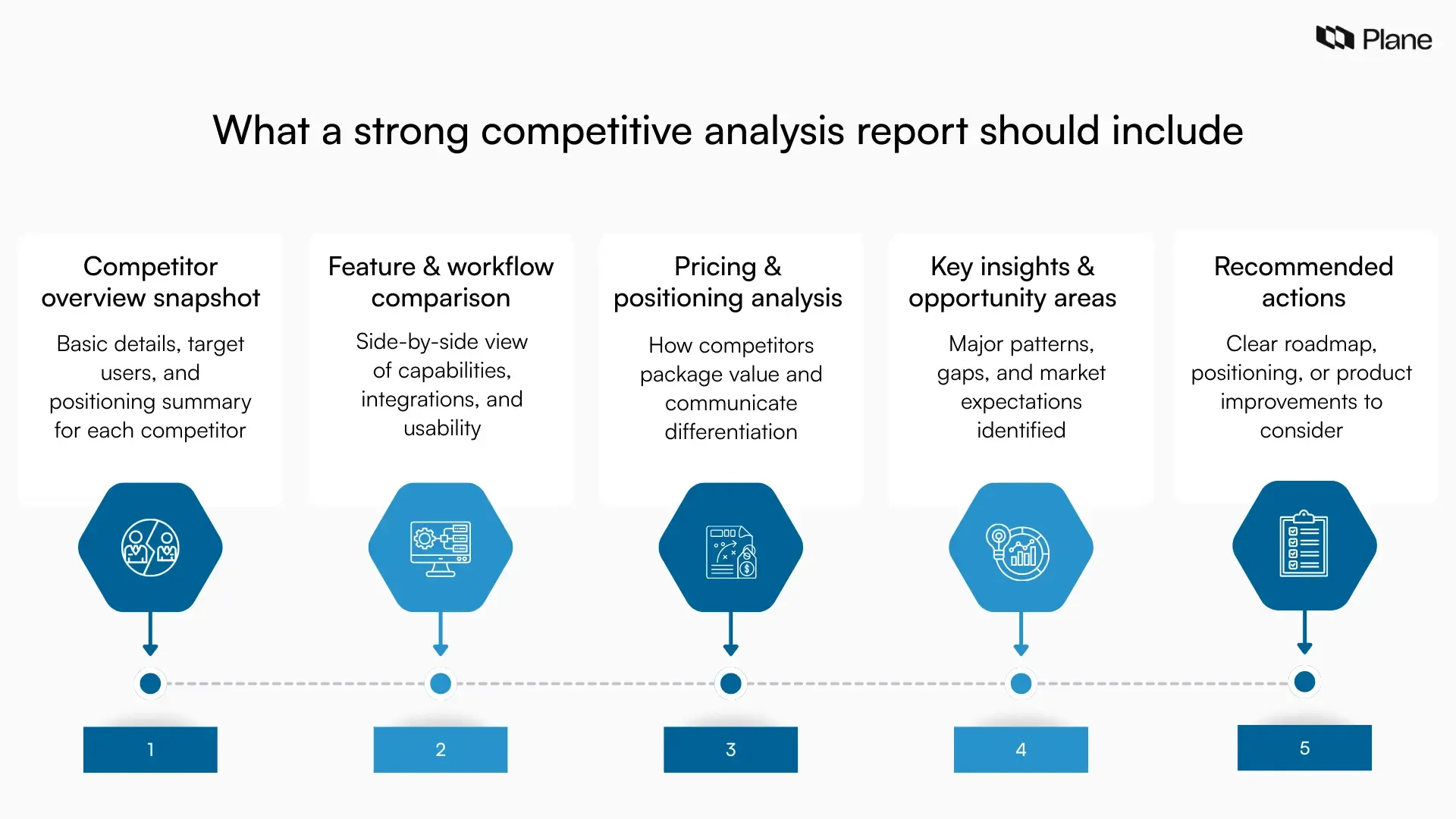

What to include in a competitive analysis report

The goal of a competitive analysis report is clarity. It should show where your product stands, what competitors are doing well, and what actions the team should consider next. The following structure keeps competitive analysis in product management practical and decision-focused.

1. Competitor overview snapshot

Start with a quick snapshot of each competitor. This helps stakeholders understand the landscape at a glance before diving into deeper comparisons.

Include:

- Competitor name and category

- Target audience or segment

- Core positioning and value proposition

- Key strengths and notable limitations

- Pricing starting point or model

Keep this section concise. The goal is to provide context that makes deeper analysis easier to interpret.

2. Feature and capability comparison

A structured comparison table helps teams evaluate how products support key workflows and capabilities. Focus on areas that influence user decisions rather than listing every available feature.

Compare:

- Core workflows and functionality

- Integrations and ecosystem support

- Customization and flexibility

- Collaboration or reporting capabilities

- Onboarding and usability signals

Clear comparisons support stronger roadmap and prioritization discussions.

3. Pricing and positioning analysis

Pricing and positioning shape how products are perceived in the market. This section explains how competitors package value and communicate their strengths.

Capture:

- Pricing tiers and structure

- Feature distribution across plans

- Value metrics such as user-based or usage-based pricing

- Positioning language and target segment

- Trial or free plan strategy

Understanding these elements helps product managers evaluate whether their own pricing and messaging align with the value they deliver and the audience they serve.

4. Key insights and opportunity areas

This section translates data into meaning. Instead of repeating observations, summarize the most important insights across competitors.

Highlight:

- Common strengths across the category

- Recurring weaknesses or user complaints

- Unmet needs or gaps

- Shifts in positioning or investment areas

Each insight should clearly explain its implications for your product. This helps teams move from observation to strategic understanding.

5. Recommended actions

End the report with clear recommendations. Competitive analysis for product managers should guide decisions rather than remain descriptive.

Recommended actions may include:

- Roadmap priorities to strengthen differentiation

- Usability improvements to reduce friction

- Positioning or messaging adjustments

- Pricing or packaging refinements

- Areas that require further validation with users

A concise action section ensures the analysis supports real product decisions. It also helps teams revisit the report later and track how insights influenced strategy and execution.

Common competitive analysis mistakes to avoid

Competitive analysis delivers value only when it leads to a clear understanding and better decisions. Many teams invest time in gathering data but still miss useful insights because their approach remains surface-level. The following pitfalls often reduce the impact of competitive analysis for product managers.

1. Focusing only on features

Feature comparisons alone rarely explain why users choose one product over another. Positioning, usability, pricing clarity, and perceived value influence decisions just as much as capability depth. A strong competitive analysis evaluates workflows, onboarding experience, messaging, and customer sentiment alongside features. This broader view reveals where real differentiation exists and where improvements matter most.

2. Treating analysis as a one-time exercise

Markets evolve quickly as competitors release updates, refine positioning, and adjust pricing. A one-time analysis becomes outdated within months and loses relevance for decision-making. Treat competitive analysis in product management as an ongoing habit. Review the landscape periodically and update insights when major launches, pricing changes, or positioning shifts occur. Regular updates keep product strategy aligned with current market conditions.

3. Copying competitors instead of differentiating

Copying competitor features without context often results in products that feel similar but offer no clear value. Competitive analysis should highlight opportunities for differentiation rather than encourage parity. Use insights to understand patterns and expectations, then decide where your product should stand apart. Strong differentiation builds trust and clarity for users while supporting long-term product strategy.

4. Collecting data without turning it into decisions

Competitive analysis loses impact when findings remain descriptive. Data must connect directly to product decisions, experiments, or positioning updates. Summarize key insights and define recommended actions after each analysis. Linking insights to roadmap priorities and strategy discussions ensures that competitive analysis for product managers drives real progress rather than becoming static documentation.

Final thoughts

Competitive analysis in product management works best when treated as a continuous source of clarity rather than a periodic research task. Product teams operate in dynamic markets where positioning, pricing, and user expectations shift quickly. Staying aware of the competitive landscape helps teams make informed, confident decisions.

A structured competitive analysis for product managers focuses on what truly matters. It helps teams understand where they stand, where real opportunities exist, and how to build with clear intent. When competitive analysis becomes part of regular product thinking, it supports better roadmap decisions, sharper positioning, and more deliberate product strategy over time.

Frequently asked questions

Q1. What is competitive analysis in product management?

Competitive analysis in product management is the structured evaluation of competing and alternative products to understand their strengths, gaps, positioning, and pricing. Product managers use it to identify opportunities for differentiation, track market expectations, and make informed decisions about the roadmap and strategy.

Q2. How do product managers conduct competitive analysis?

Product managers conduct competitive analysis by defining a goal, selecting key competitors, and comparing them across features, pricing, positioning, and user experience. They gather data from product trials, reviews, and websites, then convert insights into roadmap priorities, positioning updates, or product improvements.

Q3. What should a competitive analysis include?

A competitive analysis should include competitor overviews, feature and workflow comparisons, pricing and positioning insights, and key opportunity areas. It should clearly show where competitors perform well, where gaps exist, and what actions the product team should consider next.

Q4. What frameworks are used for competitive analysis?

Common competitive analysis frameworks include feature comparison matrices, SWOT analyses, positioning maps, Porter’s Five Forces, and customer journey comparisons. Product managers choose a framework based on whether they need roadmap clarity, positioning insight, or a broader market view.

Q5. How often should competitive analysis be updated?

Competitive analysis should be updated regularly as part of an ongoing product strategy. Many teams review it quarterly or before major roadmap, pricing, or positioning decisions. It should also be refreshed when competitors launch significant features or shift direction.

Recommended for you