Introduction

A launch is a bet on user behavior. Product launch metrics show whether that bet pays off. Pre-launch metrics test readiness and positioning; launch-phase metrics track activation and time-to-value; and post-launch metrics reveal retention and the depth of adoption. When teams intentionally track launch metrics, product launch success becomes measurable rather than assumed. This guide covers the most important product launch metrics across every phase, helping teams measure post-launch success and improve outcomes with each release.

What are product launch metrics?

Product launch metrics are the measurements teams use to evaluate how a product performs across its launch lifecycle. These metrics help teams understand whether a launch reaches the right audience, whether users experience value early, and whether that value continues after release. Product launch metrics turn launches into measurable systems by connecting user behavior, adoption patterns, and outcomes to clear signals of success.

Why product launch metrics matter

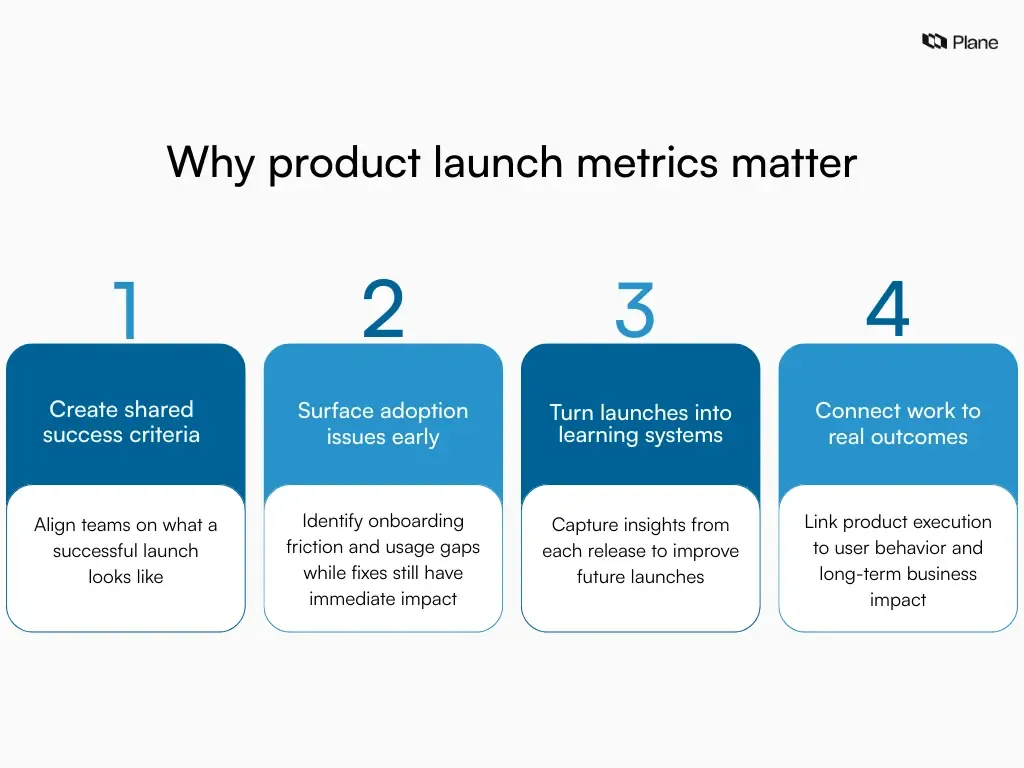

Product launches create momentum, but momentum alone does not explain impact. Product launch metrics matter because they give teams a shared way to understand what actually changed after a release. They replace assumptions with observable signals and help teams learn faster from every launch.

1. They create a shared definition of success

Launches often mean different things to different teams. Marketing may look at reach, product may look at usage, and engineering may look at stability. Product launch metrics align everyone around the same outcomes by defining what success looks like before and after release. When teams agree on a small set of launch metrics, reviews become clearer, and decisions move faster.

2. They surface adoption and onboarding issues early

Early usage patterns reveal more than launch-day numbers. Launch-phase metrics, such as activation rate and time to first value, indicate where users struggle to get started. These signals help teams address onboarding gaps, unclear flows, or missing guidance while the launch is still fresh, rather than discovering issues weeks later through churn.

3. They turn launches into learning loops

Every launch teaches something about users, positioning, and workflows. Product launch metrics capture those lessons in a structured way. By reviewing pre-launch, launch, and post-launch metrics together, teams can understand what worked, what slowed adoption, and what to improve in the next release.

4. They connect product work to real outcomes

Launch metrics help teams see how product changes affect real behavior. Post-launch metrics such as retention, feature adoption, and usage depth show whether users continue to rely on what was shipped. When paired with business signals such as expansion or conversions, product launch metrics connect day-to-day execution to long-term impact.

Tracking product launch metrics helps teams move beyond launch-day excitement and build products that create lasting value.

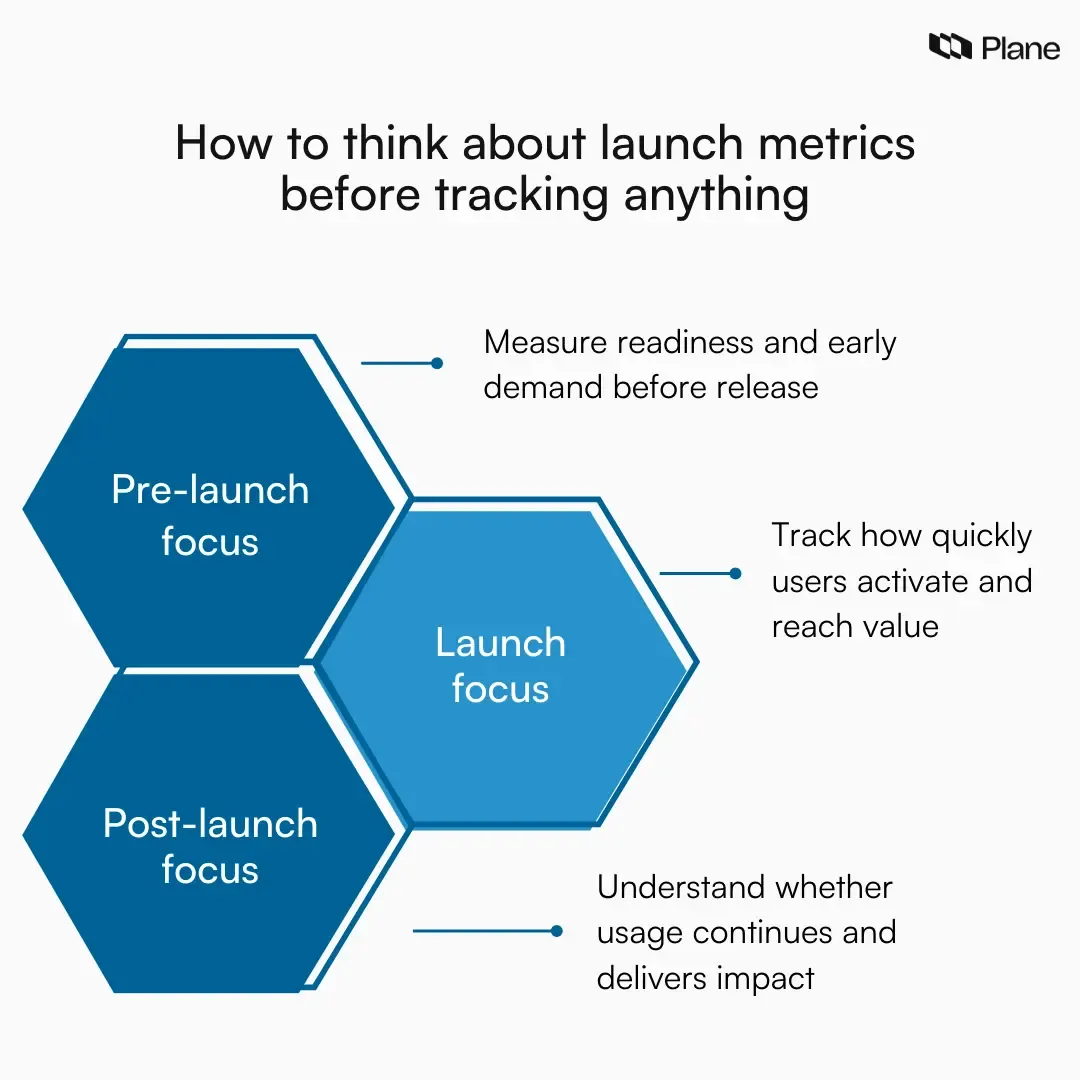

How to think about launch metrics before tracking anything

Tracking launch metrics works best when teams start with a clear mental model. Without one, dashboards grow quickly, and insights stay shallow. A simple way to stay focused is to recognize that launch metrics change by phase and that each phase answers a specific question.

Launch metrics change by phase

Each stage of a launch reflects a different moment in the user journey, so the metrics you track should evolve accordingly.

- Pre-launch metrics answer whether the team is ready and whether there is clear demand. These metrics show whether messaging resonates, onboarding flows are in place, and internal systems can support the release.

- Launch phase metrics answer whether users reach value quickly. They focus on activation, early usage, and the speed at which users complete meaningful actions.

- Post-launch metrics answer whether the value sticks. They measure retention, adoption depth, and whether the product becomes part of regular workflows.

A simple rule for choosing metrics

For each phase, select one primary metric that reflects success and support it with three to four secondary metrics. This keeps launch metrics actionable, reviewable, and tied to clear decisions rather than surface-level reporting.

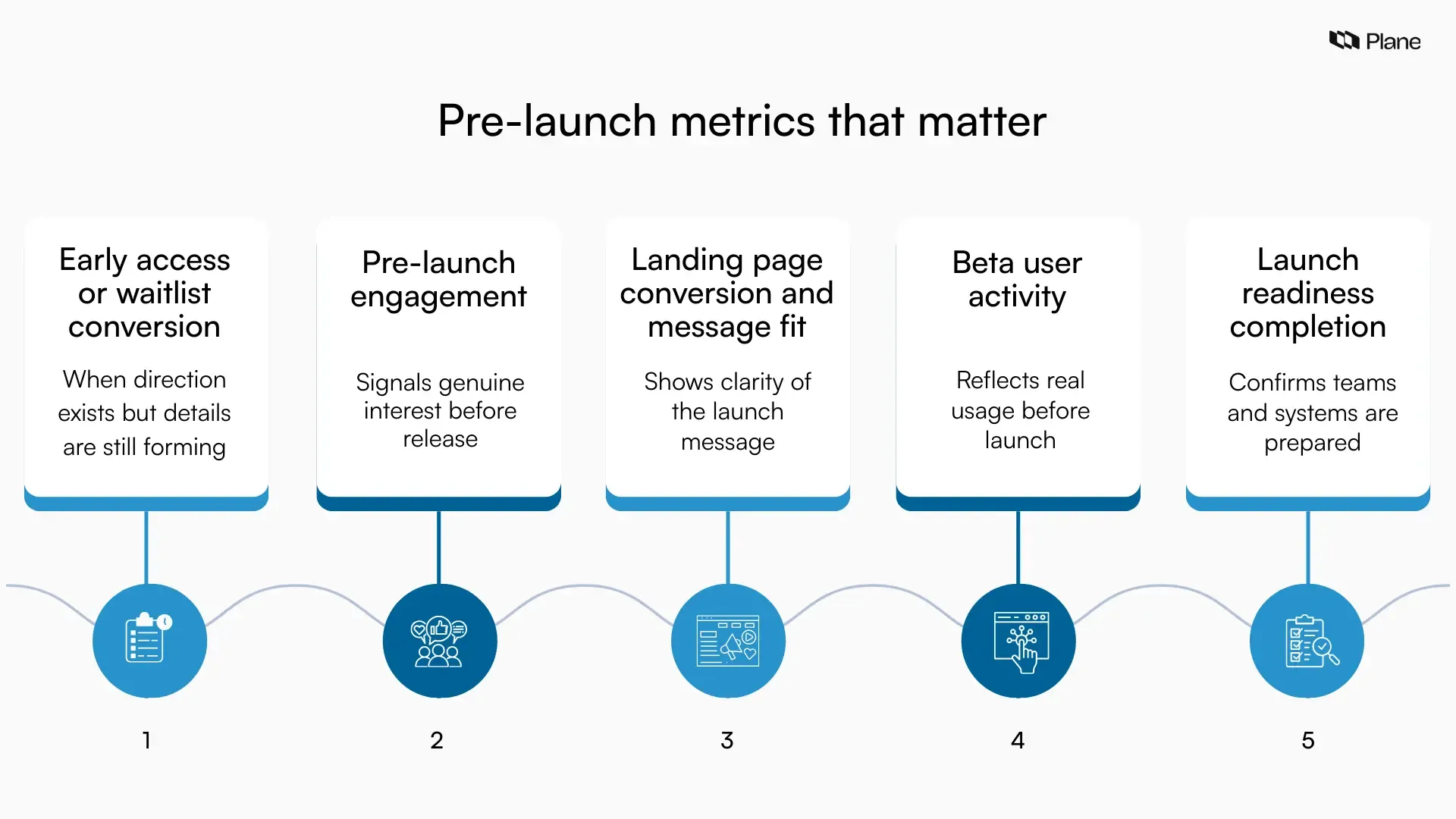

Pre-launch metrics that matter

Pre-launch metrics shape the quality of everything that follows. They show whether interest is real and whether the product can support users once the switch flips. Teams that treat pre-launch metrics seriously spend less time fixing preventable issues after release. Let’s explore the essential pre-launch metrics to monitor,

1. Early access or waitlist conversion rate

This metric measures how many visitors opt in when offered early access or a waitlist. It reflects how clearly the value proposition resonates with the target audience. For example, if a feature announcement attracts traffic but few users sign up for early access, the message may explain what the feature is without explaining why it matters.

2. Pre-launch engagement rate

Pre-launch engagement tracks how actively potential users interact with launch-related touchpoints such as emails, demos, webinars, or documentation. Consistent engagement across multiple touchpoints signals intent rather than curiosity. For example, users who attend a demo and later read setup documentation show stronger readiness than users who only open an announcement email.

3. Landing page conversion and message fit

This metric measures how effectively a launch page converts visits into meaningful actions, such as sign-ups or demo requests. Reviewing scroll depth, click patterns, and drop-off points helps teams understand which messages resonate. If users consistently pause on use-case sections but skip feature lists, the page may need to emphasize outcomes more clearly.

4. Beta user activity

Beta activity measures how early users interact with the product in real workflows. It includes actions completed, frequency of use, and feature exploration. For example, if beta users create projects but never return to update them, the product may deliver initial value without supporting ongoing usage. These patterns surface usability and workflow gaps early.

5. Launch readiness completion

Launch readiness completion tracks whether critical preparation tasks are finished before release. This includes analytics instrumentation, onboarding flows, documentation, support readiness, and rollback plans. A completed readiness checklist ensures teams can measure behavior, respond to issues, and learn from usage as soon as the launch begins.

Together, these pre-launch metrics help teams enter launch week with clear signals about demand quality and readiness, reducing surprises once real users arrive.

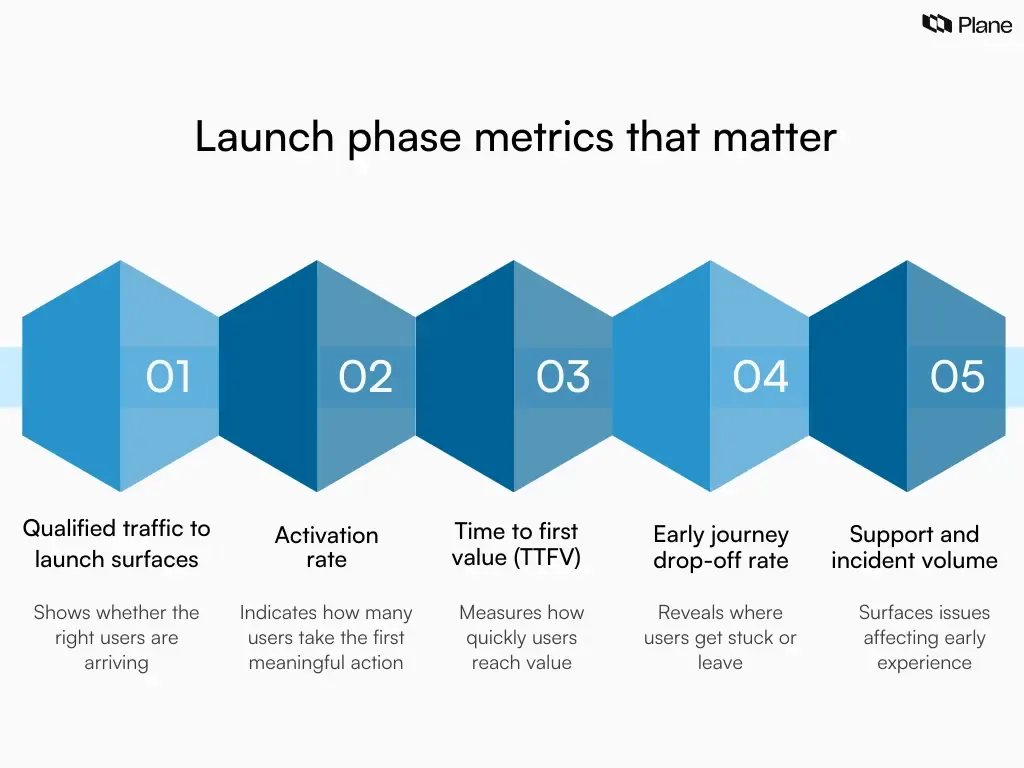

Launch phase metrics that matter

Launch phase metrics show how users respond when the product is live. These metrics focus on early behavior and help teams understand whether users move from interest to meaningful action. Strong launch-phase metrics reveal how quickly users derive value and where friction appears in the first experience. Here are the key metrics to monitor during the launch phase:

1. Qualified traffic to launch surfaces

This metric measures visits from users who match the intended audience, rather than total traffic volume. Qualified traffic includes visits from target segments, high-intent channels, or existing users likely to benefit from the release. For example, a spike in traffic from a broad announcement matters less than steady visits from teams actively managing projects or evaluating tools. Tracking traffic quality helps teams accurately interpret launch interest.

2. Activation rate

Activation rate shows how many new or returning users complete the key action that signals real intent. This action should represent a meaningful step toward value, such as creating a project, configuring a workflow, or inviting teammates. A healthy activation rate indicates that users understand what to do next and find the product usable in their first session.

3. Time to first value (TTFV)

TTFV measures how long it takes users to experience a meaningful outcome after starting. This could be completing a setup step, seeing progress in a workflow, or achieving a clear result. Shorter TTFV usually correlates with higher adoption because users quickly understand the product’s value. Tracking TTFV helps teams identify steps that slow users down during onboarding.

4. Early journey drop-off rate

This metric tracks where users abandon the product during their first journey. Drop-offs often occur during sign-up, onboarding, setup, or the first attempt at a key action. For example, if many users exit during team invitations, it may indicate unclear instructions or unnecessary friction. Identifying these points early helps teams prioritize fixes that improve first-time experiences.

5. Support and incident volume

Support and incident volume measure the number and type of issues users report during launch. These signals highlight confusion, bugs, or missing guidance. Patterns in support requests often point to the same friction areas seen in drop-off data. Reviewing this metric alongside activation and TTFV helps teams distinguish between usability issues and technical instability.

Together, these launch-phase metrics help teams understand how users experience the product in real time and where to focus improvements as the launch unfolds.

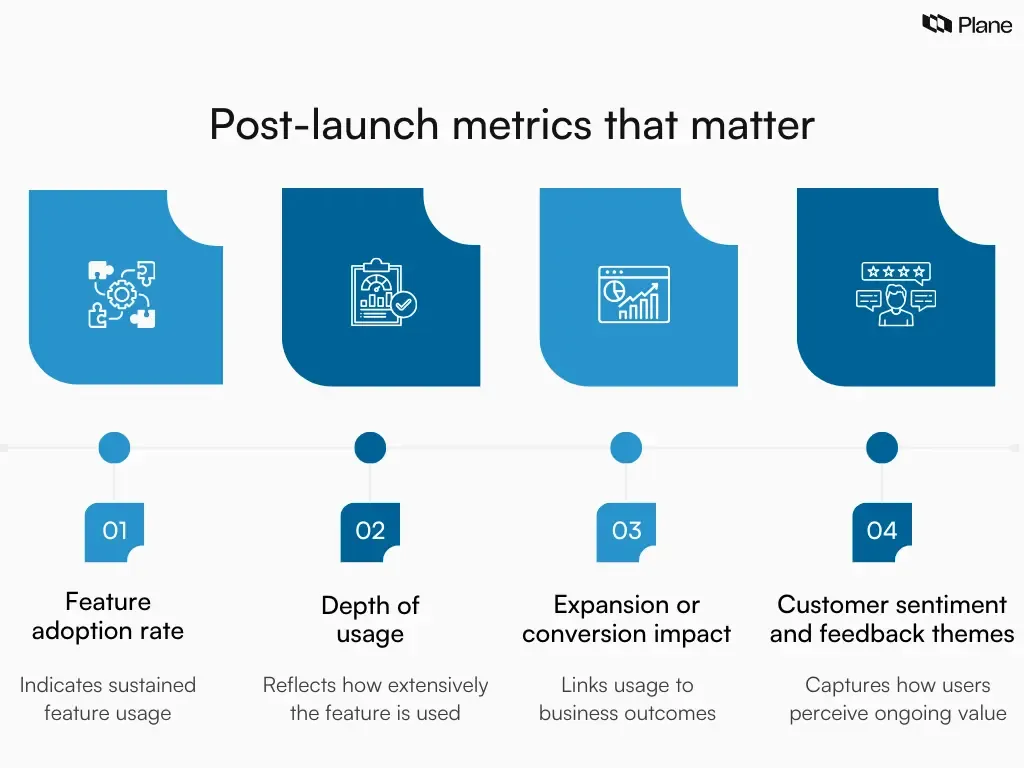

Post-launch metrics that matter

Post-launch metrics help teams understand whether a launch creates lasting value. These metrics focus on repeat behavior, real workflow adoption, and outcomes that extend beyond initial usage. When reviewed consistently, post-launch metrics show whether a feature becomes part of everyday work or fades after early interest.

1. Feature adoption rate

Feature adoption rate measures the percentage of eligible users who actively use the feature after it is launched. This metric focuses on meaningful usage rather than first-time interaction. For example, tracking how many teams create and update pages over time provides a clearer signal of adoption than counting page views. Adoption rate helps teams understand whether the feature fits real workflows.

2. Depth of usage

Depth of usage captures how extensively users rely on the feature. It looks at frequency, repetition, and breadth across projects or teammates. For example, a feature used weekly across multiple projects reflects stronger adoption than one used once in a single project. This metric helps teams distinguish between surface-level use and embedded behavior.

3. Expansion or conversion impact

This metric connects the launch to business outcomes. It includes trial-to-paid conversion, upgrades, seat expansion, or renewals influenced by the feature. For example, if teams mention the new feature during upgrade conversations, it signals that the launch contributes to perceived value. Expansion impact helps teams understand how the product works to support growth.

4. Customer sentiment and feedback themes

Customer sentiment captures how users feel about the feature through surveys, support conversations, and qualitative feedback. Repeated themes reveal clarity, friction, and perceived usefulness. For example, consistent feedback about setup complexity points to onboarding improvements, while repeated praise for flexibility signals strong alignment with user needs.

Together, these post-launch metrics help teams evaluate whether a launch delivers sustained value, supports real work, and contributes to long-term product outcomes.

Common mistakes teams make with launch metrics

Launch metrics lose value when they create confidence without insight. These mistakes appear frequently across teams and often lead to incorrect conclusions about launch success.

1. Focusing on vanity metrics as indicators of success

Metrics such as page views, sign-ups, or announcement reach create visibility but rarely explain user value. When teams treat these numbers as proof of success, they miss signals around activation, usage, and retention. Strong launch metrics reflect behavior, not attention.

2. Defining activation too loosely

Activation events that require minimal effort inflate success metrics without representing real intent. When activation occurs before users experience meaningful value, the metric becomes less useful. Clear activation definitions should reflect actions that demonstrate commitment and actual use.

3. Reviewing metrics without a baseline or comparison window

Launch metrics need context to be meaningful. Without comparing results to previous launches, earlier cohorts, or pre-launch baselines, teams struggle to interpret progress. Relative change over time provides clearer insight than isolated numbers.

4. Collecting feedback without closing the loop

User feedback often surfaces quickly after launch, yet insights lose impact when they remain disconnected from action. Support themes, survey responses, and qualitative signals should inform onboarding changes, messaging updates, or product improvements. Metrics gain value when feedback leads to visible decisions.

Avoiding these mistakes helps teams use product launch metrics as tools for learning and improvement rather than surface-level reporting.

Wrapping up

A successful launch extends far beyond release day. Product launch metrics help teams understand whether a product reaches the right users, delivers value early, and continues to support real work over time. When teams track the right metrics across pre-launch, launch, and post-launch phases, launches become repeatable learning systems rather than isolated events. Clear launch metrics create focus, improve decision-making, and reveal what to refine in future releases. Teams that consistently review these metrics build stronger products because they learn faster from real-world usage. Over time, product launch metrics turn execution into insight and releases into lasting impact.

Frequently asked questions

Q1. What are metrics that matter?

Metrics that matter are measurements that reflect real user behavior and outcomes. They show whether users derive value from the product, continue using it, and rely on it in their daily work. In the context of product launch metrics, these include activation, retention, adoption depth, and outcome-driven signals rather than surface-level activity.

Q2. What are the 4 P’s of product launch?

The four P’s of a product launch are product, positioning, promotion, and performance. Product defines what is being launched and who it serves. Positioning explains why it matters. Promotion covers how it reaches the audience. Performance focuses on product launch metrics that measure adoption, usage, and long-term impact after release.

Q3. What are L0, L1, and L2 metrics?

L0, L1, and L2 metrics represent different levels of measurement depth. L0 metrics track visibility and reach, such as traffic or impressions. L1 metrics track engagement and early actions, such as activation or onboarding completion. L2 metrics track sustained value, including retention, feature adoption, and usage depth.

Q4. What are the 5 most important metrics for product performance?

The five most important product performance metrics are activation rate, time to first value, retention by cohort, feature adoption rate, and depth of usage. Together, these metrics show whether users find value quickly and continue to rely on the product over time.

Q5. What are the 5 key quality indicators?

Key quality indicators focus on reliability and user experience. These include product stability, error frequency, performance consistency, workflow clarity, and customer-reported issues. When reviewed alongside product launch metrics, quality indicators help teams understand how execution affects adoption and retention.

Recommended for you