What is project budget management? Definition, process and best practices

Project budget management is defined as the process of planning, allocating, monitoring, and controlling the financial resources of a project to ensure that it is completed within its approved budget.

Project budget management is defined as the process of planning, allocating, monitoring, and controlling the financial resources of a project to ensure that it is completed within its approved budget.

Introduction

Projects succeed when financial decisions keep pace with execution. Project budget management brings structure to how teams plan costs, track spending, and respond to change as work progresses.

In this guide, we explore what project budget management involves, what a project budget includes, and how to create a project budget that aligns with real project needs. You will learn how to manage a project budget during execution, monitor actual costs and forecasts, handle risks, and apply project budget management best practices that help teams deliver with confidence and consistency.

What is project budget management?

Project budget management is defined as the process of planning, allocating, monitoring, and controlling the financial resources of a project to ensure that it is completed within its approved budget.

It involves estimating costs, tracking expenditures, and making adjustments as necessary to align with the project's goals and constraints. Budget management is critical for maintaining financial control and ensuring efficient resource utilization throughout the project lifecycle.

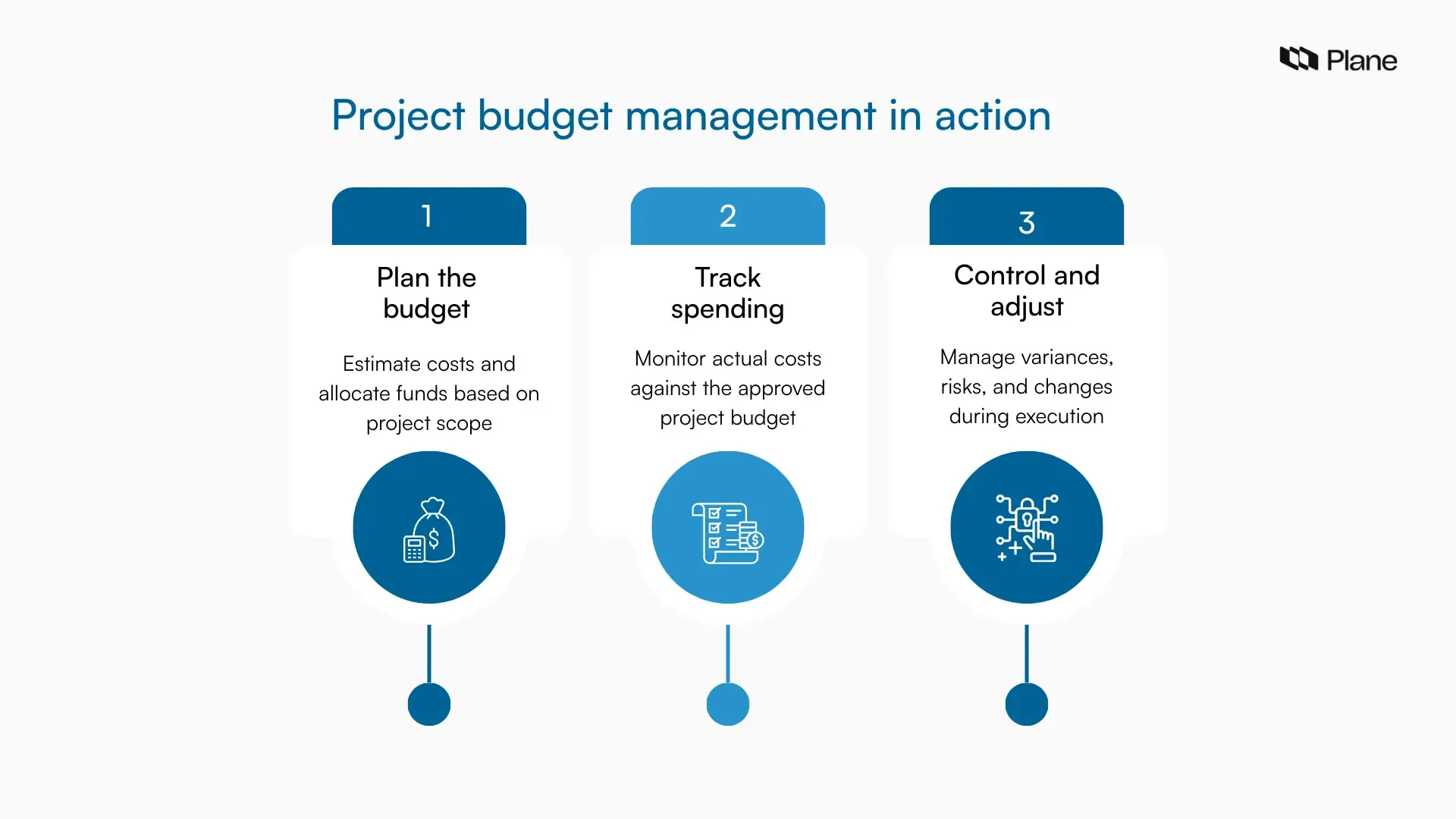

The process begins with budget planning, where project managers estimate the costs of resources, labor, materials, and overheads required for project completion. This initial budget serves as a baseline against which all financial activities are measured. During the execution phase, expenditures are monitored continuously to identify variances between the planned and actual costs. This allows project managers to address discrepancies promptly and avoid financial overruns.

Budget management also includes forecasting and financial reporting, which help stakeholders stay informed about the project's financial health. Accurate forecasts ensure that the project remains financially viable, while periodic reports provide transparency and accountability. Effective budget management requires tools like spreadsheets, project management software, or enterprise resource planning (ERP) systems to streamline data collection, analysis, and reporting.

For example, consider a project to implement an enterprise software solution. The project budget includes costs for licensing, hardware, training, and external consultants. During implementation, the project team discovers additional integration needs with existing systems, increasing costs. With proper budget management, the team reviews the contingency funds allocated for such risks and reassigns them to cover these expenses without exceeding the overall budget. This demonstrates how proactive budget management ensures that unexpected challenges are managed without compromising project objectives or financial stability.

What is a project budget?

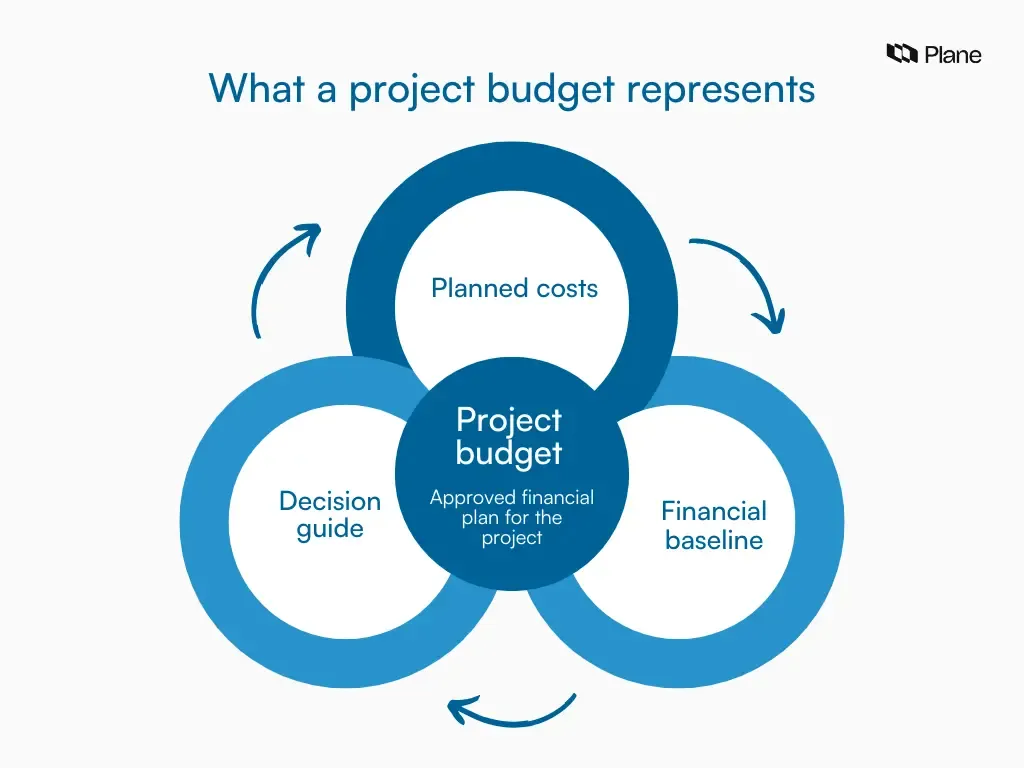

A project budget is more than just a number approved at the start of a project. It is a structured financial plan that shows how much money the project is expected to spend, where that money will go, and when it will be used. A clear project budget helps teams plan work realistically, make informed decisions, and keep costs under control as the project progresses.

What does a project budget represent?

At its core, a project budget represents the total expected cost of delivering a project. It brings together all planned expenses, including labor, materials, tools, vendor costs, and overheads, into one view. This budget reflects the scope of work agreed upon and translates project plans into financial terms. In project budget management, this becomes the reference point for all cost-related decisions.

How a project budget becomes the financial baseline

Once a project budget is reviewed and approved, it becomes the financial baseline for the project. This baseline is used to compare planned costs with actual spending throughout execution. As teams track expenses, they measure performance against this baseline to understand whether the project is on track, over budget, or underspending. Effective project budget management relies on this baseline to support forecasting, cost control, and timely corrective action.

Having a budget vs managing a project budget

Having a project budget means that costs were estimated and approved at the start. Managing a project budget means actively tracking spending, reviewing variances, updating forecasts, and responding to changes as the project evolves. Project budgeting focuses on planning the numbers, while project budget management focuses on controlling those numbers during execution. This ongoing management is what helps teams avoid overruns and deliver projects with financial clarity.

Project budgeting vs project budget management

Project budgeting and project budget management are closely related, but they serve different purposes at different stages of a project. Understanding the distinction helps teams plan better and stay in control as work progresses.

What is project budgeting?

Project budgeting focuses on estimating and planning costs before the project begins. It involves identifying the scope of work, estimating expenses for labor, materials, tools, and overheads, and combining these estimates into a project budget. The goal of project budgeting is to create a realistic financial plan that aligns with project goals and constraints.

What is project budget management?

Project budget management begins once the project is approved and execution starts. It involves tracking actual spending against the budget, monitoring variances, updating forecasts, and making adjustments when conditions change. While project budgeting sets the numbers, project budget management ensures those numbers are actively controlled throughout the project lifecycle.

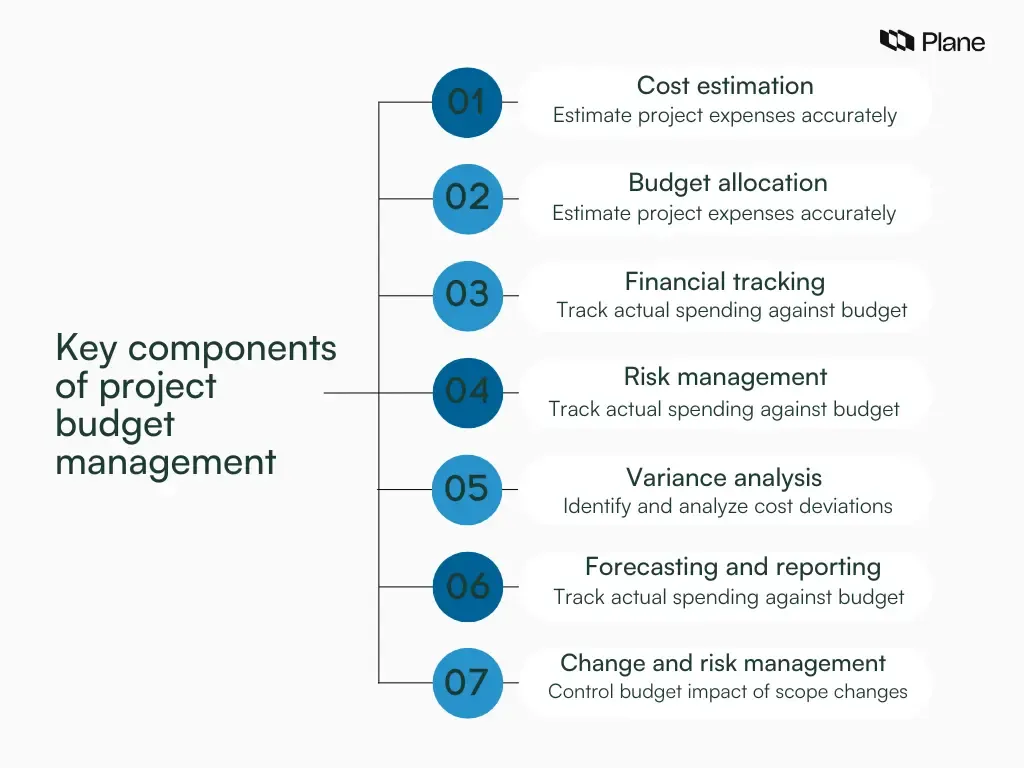

Key components of project budget management

Project budget management involves various components that ensure effective financial planning, monitoring, and control throughout a project’s lifecycle. Below are the key components of project budget management explained in detail:

- Cost estimation

Cost estimation is the foundation of budget management, where all project expenses are forecasted based on resource requirements, labor costs, materials, equipment, and overheads. Accurate cost estimation ensures that the budget reflects the true financial needs of the project. For example, in a construction project, cost estimation includes expenses for raw materials, machinery, and worker salaries.

- Budget allocation

Once costs are estimated, the total budget is divided into categories or tasks, ensuring that funds are allocated to each aspect of the project appropriately. Budget allocation ensures that critical activities are sufficiently funded, such as design, implementation, and risk management. For instance, a marketing project may allocate a portion of its budget to digital ads, another to events, and the rest to content creation.

- Financial tracking and monitoring

This involves regularly comparing actual expenditures against the planned budget to identify any variances. Tracking helps detect overspending or underutilization early, enabling corrective actions. For example, project management tools like Microsoft Project or QuickBooks can track expenses *

- Risk management and contingency planning

Effective budget management includes allocating contingency funds to address unforeseen expenses or risks. This buffer ensures that the project can handle unexpected challenges without financial strain. For example, a software development project might reserve 10% of its budget for risks like scope changes or technical issues.

- Variance analysis

Variance analysis involves identifying and analyzing differences between planned and actual costs. It helps understand the causes of discrepancies and guides decisions to bring the project back on track. For instance, if labor costs exceed estimates due to overtime, variance analysis helps adjust resource allocation or timelines to manage costs.

- Forecasting and reporting

Budget forecasting involves predicting future financial needs based on current trends and progress, while reporting ensures stakeholders remain informed about the project’s financial health. Regular financial updates and accurate forecasts allow for proactive adjustments to avoid budget overruns. For example, monthly financial reports in a construction project may highlight trends in material costs, prompting early negotiations with suppliers.

- Change management

Changes in project scope or requirements often affect the budget. Change management ensures that any adjustments are evaluated and approved before implementation, maintaining financial control. For instance, adding new features to a software product would require reassessing costs and adjusting the budget accordingly.

Inputs required before creating a project budget

A reliable project budget starts with the right inputs. Without clear planning inputs, project budgeting often turns into guesswork, leading to cost overruns later. Before estimating costs, teams need a shared understanding of what will be delivered, how the work will be done, and what risks could affect spending.

1. Project scope and work breakdown structure (WBS)

The project scope defines what the project will deliver, while the work breakdown structure breaks that scope into manageable tasks. Each task in the WBS serves as a unit for estimating costs, making it easier to build an accurate project budget and avoid overlooked expenses.

2. Project schedule

The project schedule shows when work will happen and when costs will be incurred. It helps teams understand spending timing, manage cash flow, and plan funding needs throughout the project timeline. In project budget management, schedule and budget always work together.

3. Resource plan

A resource plan outlines who will work on the project and what skills or tools are required. This input is essential for estimating labor costs, tool usage, and vendor support. Clear resource planning leads to more realistic project budgeting.

4. Risk register

The risk register captures potential events that could impact project costs, such as scope changes, delays, or price fluctuations. Identifying these risks early helps teams plan contingency allowances and strengthen overall project budget management.

How to make a project budget

Creating a project budget is a structured process that turns plans into clear financial expectations. These steps help teams move from scope to an approved budget that can be managed throughout execution.

1. Define the scope and break the work into tasks

Start by clearly defining the project scope and breaking it down into tasks using a work breakdown structure. This ensures every piece of work is visible and accounted for. Each task becomes the basis for estimating costs during project budgeting.

2. Estimate costs for each task

Estimate the cost of labor, materials, tools, and vendor support for every task in the WBS. Use historical data, expert input, or similar projects to improve accuracy. Detailed estimates lead to a more reliable project budget.

3. Add contingency reserves

Once base estimates are in place, add contingency reserves to account for identified risks and uncertainties. This helps manage expected cost variations without disrupting the overall budget during execution.

4. Roll up costs and get approval

Combine all task-level estimates and contingency into a total project budget. Review it with stakeholders, align on assumptions, and secure formal approval. Once approved, this budget becomes the financial baseline for project budget management.

How to track and control a project budget during execution

Once a project moves into execution, project budget management shifts from planning to active control. The goal is to understand how spending compares to expectations and to respond early when costs start to drift.

1. Budgeted cost, actual cost, and forecast

The budgeted cost represents what was approved during project budgeting. Actual cost shows what has been spent so far. The forecast estimates the total cost by the end of the project based on current trends. Tracking all three together gives a clear view of financial performance and helps teams manage project budgets with confidence.

2. Identifying and reviewing variances

Variance is the difference between budgeted and actual costs. Regular reviews help teams spot overspending or underspending early. By analyzing the cause of the variance, teams can determine whether it is a one-time issue or a trend that warrants attention.

3. Taking corrective action and re-forecasting

When variances indicate a potential overrun, corrective action may be required. This can include reallocating resources, adjusting timelines, or refining scope through change control. If spending patterns change significantly, re-forecasting helps update expectations and keeps project budget management aligned with reality.

Contingency reserve and change control

Contingency reserve and change control play a key role in keeping a project budget stable as work progresses. Together, they help teams respond to uncertainty without losing financial control.

What is a contingency reserve, and why does it exist?

A contingency reserve is a portion of the project budget set aside to cover expected risks identified during planning. These are known uncertainties, such as potential delays, price fluctuations, or minor scope adjustments. In project budget management, contingency reserves allow teams to handle these situations without disrupting the approved budget or pausing execution.

Expected risks vs scope changes

Expected risks are events the team anticipates and plans for in advance, which is why contingency reserves cover them. Scope changes, on the other hand, introduce new work that was not part of the original plan. These changes usually require additional funding and cannot be absorbed by contingency alone. Clear project budgeting makes this distinction easier to manage.

How change control protects the project budget

Change control ensures that any change affecting cost, scope, or timeline is reviewed and approved before implementation. This process helps teams assess financial impact, update forecasts, and adjust the project budget in a controlled way. Strong change control is essential for effective project budget management and long-term cost control.

Importance of budget management in project management

Budget management is a critical aspect of project management as it ensures financial control, resource optimization, and the successful completion of projects within the allocated financial constraints. Its importance is reflected in the following areas:

1. Ensures financial control

Effective budget management helps project managers maintain oversight of all project expenses, ensuring that costs stay within the approved limits. Without proper control, projects are at risk of overspending, which can lead to financial shortfalls and even project failure. For example, a construction project with poor budget management might run out of funds before completing critical stages, delaying project delivery or compromising quality.

2. Facilitates resource allocation

Budget management ensures that resources such as labor, materials, and tools are allocated effectively to different project tasks. Proper allocation minimizes waste and ensures that every dollar spent contributes directly to project objectives. For instance, in a marketing campaign, careful budget allocation ensures enough funding for high-impact activities like digital advertising or influencer partnerships.

3. Supports decision-making and prioritization

A well-managed budget provides accurate financial data that helps project managers and stakeholders make informed decisions. It allows them to prioritize activities, reallocate funds as needed, and respond to changes in scope or risks. For example, if a software development project encounters unexpected costs during testing, a managed budget enables the team to assess options and redirect funds without compromising core deliverables.

4. Builds stakeholder confidence

Stakeholders, including sponsors and clients, are more likely to trust a project managed with clear financial oversight. Budget management ensures transparency through regular financial reporting, which helps stakeholders monitor progress and stay assured that funds are being used efficiently. For instance, providing monthly budget updates in a large infrastructure project builds confidence among investors by demonstrating financial discipline.

5. Mitigates risks of delays and cost overruns

Without budget management, projects are prone to delays caused by funding shortages or inefficient use of resources. Effective budget management incorporates risk assessments and contingency planning, allowing for adjustments when unforeseen costs arise. For example, in an IT project, budget management ensures additional funds are available to address unexpected technical issues, preventing delays in delivery.

6. Contributes to project success and sustainability

A well-managed budget aligns financial resources with project goals, increasing the likelihood of delivering a successful outcome. Moreover, it ensures that the project remains financially sustainable, avoiding negative impacts on other organizational activities. For example, a nonprofit organization executing a donor-funded program can ensure funds are used responsibly, leading to successful outcomes and potential future funding.

Who is responsible for project budget management?

Project budget management is a shared responsibility, but ownership is clearly defined to maintain financial control and accountability. Each role plays a distinct part in planning, approving, and managing the project budget.

Role of the project manager

The project manager is responsible for creating the project budget, tracking actual costs, monitoring variances, and reporting budget status throughout execution. They use project budgeting inputs to plan costs and apply project budget management practices to keep spending aligned with the approved baseline.

Role of sponsors and stakeholders

Sponsors and key stakeholders provide funding, approve the project budget, and make decisions when significant cost changes arise. They review budget performance, assess trade-offs, and support corrective actions when forecasts indicate potential overruns.

Role of finance

Finance teams support project budget management through governance, compliance, and financial reporting. They help validate cost estimates, ensure spending follows organizational policies, and provide visibility into actual costs, forecasts, and funding availability.

Project budget template: What should it include?

A project budget template acts as the working document for project budget management. It brings planning and execution together by showing what was expected, what has been spent, and what remains. A well-structured template makes project budgeting easier, improves cost visibility, and helps teams take action before small issues turn into budget overruns.

Below are the core elements every practical project budget template should include.

1. Cost category

Cost categories group similar expenses, such as labor, materials, tools, vendors, or overheads. Categorization helps teams understand where money is being spent and supports high-level cost reviews during the project.

2. Line item

Line items provide a detailed breakdown within each category. Each line represents a specific expense, such as a role, task, subscription, or external service. Clear line items improve accuracy and accountability in project budget management.

3. Estimated cost

The estimated cost reflects what was planned during project budgeting. These estimates are based on scope, resources, and assumptions agreed upon at the start. They form the basis for tracking and variance analysis.

4. Actual cost

Actual cost shows the amount spent to date for each line item. Regular updates help teams monitor spending patterns and compare real costs against the project budget.

5. Remaining budget

The remaining budget highlights how much funding is still available. This view helps project managers determine whether costs are on track or require corrective action.

6. Owner and notes

Assigning an owner clarifies responsibility for each cost. Notes capture assumptions, dependencies, or changes, adding context that strengthens ongoing project budget management.

Best practices for project budget management in 2026

Effective project budget management requires implementing best practices to ensure financial control, transparency, and alignment with project goals. Below are key best practices for managing project budgets successfully:

1. Establish a detailed and realistic budget

Start with a comprehensive and accurate budget based on thorough cost estimation. Break down costs into categories such as labor, materials, equipment, and overheads to ensure no expense is overlooked. Include contingency funds for unforeseen costs. For example, a software development project might allocate 10% of its budget for unexpected integration challenges.

2. Use reliable tools and methodologies

Leverage project management software and financial tools to streamline budget tracking, forecasting, and reporting. Tools like Microsoft Project, Excel, or specialized budgeting platforms help automate calculations, visualize spending trends, and generate real-time reports. Additionally, methodologies like cost-benefit analysis and earned value management (EVM) enhance decision-making.

3. Involve stakeholders in the budgeting process

Collaborate with stakeholders to ensure the budget aligns with project objectives and priorities. Engage team members, sponsors, and clients during planning to gather insights and validate cost estimates. For instance, consulting engineers and procurement teams in a construction project ensures accurate labor and material costs.

4. Monitor costs regularly

Track expenditures continuously to identify variances between planned and actual spending. Conduct regular financial reviews to stay informed about budget performance and address discrepancies promptly. For example, a weekly review of expenses in an event planning project can prevent overspending on logistics or supplies.

5. Implement change control processes

Changes to the project scope, timeline, or resources can impact the budget. Establish a formal process for evaluating and approving changes to ensure they align with the budget and overall goals. For instance, adding a feature to a software product requires assessing its impact on development costs before proceeding.

6. Plan for risks and contingencies

Identify potential risks and allocate contingency funds to address them. This ensures the project can handle unexpected costs without jeopardizing financial stability. For example, in a construction project, a contingency fund may cover price fluctuations in building materials.

7. Communicate budget status transparently

Provide regular updates on budget performance to stakeholders through clear and concise reports. Transparency builds trust and ensures everyone understands the project’s financial health. For example, monthly budget status meetings with sponsors can highlight achievements and address concerns proactively.

8. Focus on cost efficiency

Identify opportunities to reduce costs without compromising quality. Negotiate with vendors, explore alternative materials, or streamline workflows to optimize spending. For example, in a marketing campaign, using cost-effective digital platforms instead of expensive traditional media can reduce expenses while maintaining impact.

9. Document lessons learned

After project completion, analyze budget performance and document lessons on what worked and what can be improved. For instance, if a software project consistently underestimated testing costs, this insight can guide better budgeting in subsequent initiatives.

Conclusion

Project budget management brings discipline to how projects are planned and delivered. It turns estimates into a clear project budget, helps teams track costs as work unfolds, and provides the visibility needed to make timely decisions. When project budgeting is grounded in scope, supported by realistic estimates, and paired with consistent monitoring, teams gain control over both spending and outcomes.

By understanding what goes into a project budget, how to manage it during execution, and how to respond to risks and changes, teams can reduce uncertainty and increase confidence in delivery. Strong project budget management is not just about avoiding overruns. It is about aligning financial resources with project goals and setting projects up for long-term success.

Frequently asked questions

Q1. What are the 7 steps to budgeting?

The 7 steps to budgeting are:

- Define the scope of work

- Break work into tasks

- Identify required resources

- Estimate costs for each task

- Add contingency for risks

- Roll up costs into a total budget

- Review and approve the budget

These steps form the foundation of effective project budgeting and project budget management.

Q2. What are the 7 steps of project management?

The 7 common steps of project management are:

- Initiation

- Planning

- Scope definition

- Scheduling

- Budgeting and cost planning

- Execution

- Monitoring, control, and closure

Project budget management primarily spans planning, execution, and control.

Q3. What is the 50/30/20 rule budget?

The 50/30/20 rule is a personal budgeting method where:

- 50% goes to essential needs

- 30% goes to discretionary spending

- 20% goes to savings

It is mainly used for personal finance and is not typically applied to project budgeting.

Q4. What are the 4 types of budget?

The four common types of budgets are:

- Fixed budget

- Flexible budget

- Incremental budget

- Zero-based budget

Different projects use different budget types depending on scope stability and cost certainty.

Q5. What is the 70-10-10-10 rule for money?

The 70-10-10-10 rule suggests allocating income as:

- 70% for living and spending

- 10% for savings

- 10% for investments

- 10% for giving or personal goals

Like the 50/30/20 rule, this is a personal finance framework and not a project budget management method.

Recommended for you