What is project budget? Definition, process and examples

A project budget is defined as a financial plan that estimates the total costs associated with a project over its entire duration.

A project budget is defined as a financial plan that estimates the total costs associated with a project over its entire duration.

Introduction

Shipping work always comes down to constraints. Time, people, and money shape every project decision. A project budget makes those constraints visible and manageable. It translates effort into cost, aligns teams on priorities, and supports informed trade-offs as projects progress. In project management, budgeting plays a critical role in execution rather than accounting. This guide walks through what a project budget means, how to create one step by step, what it should include, and how teams track and control budgets using practical examples.

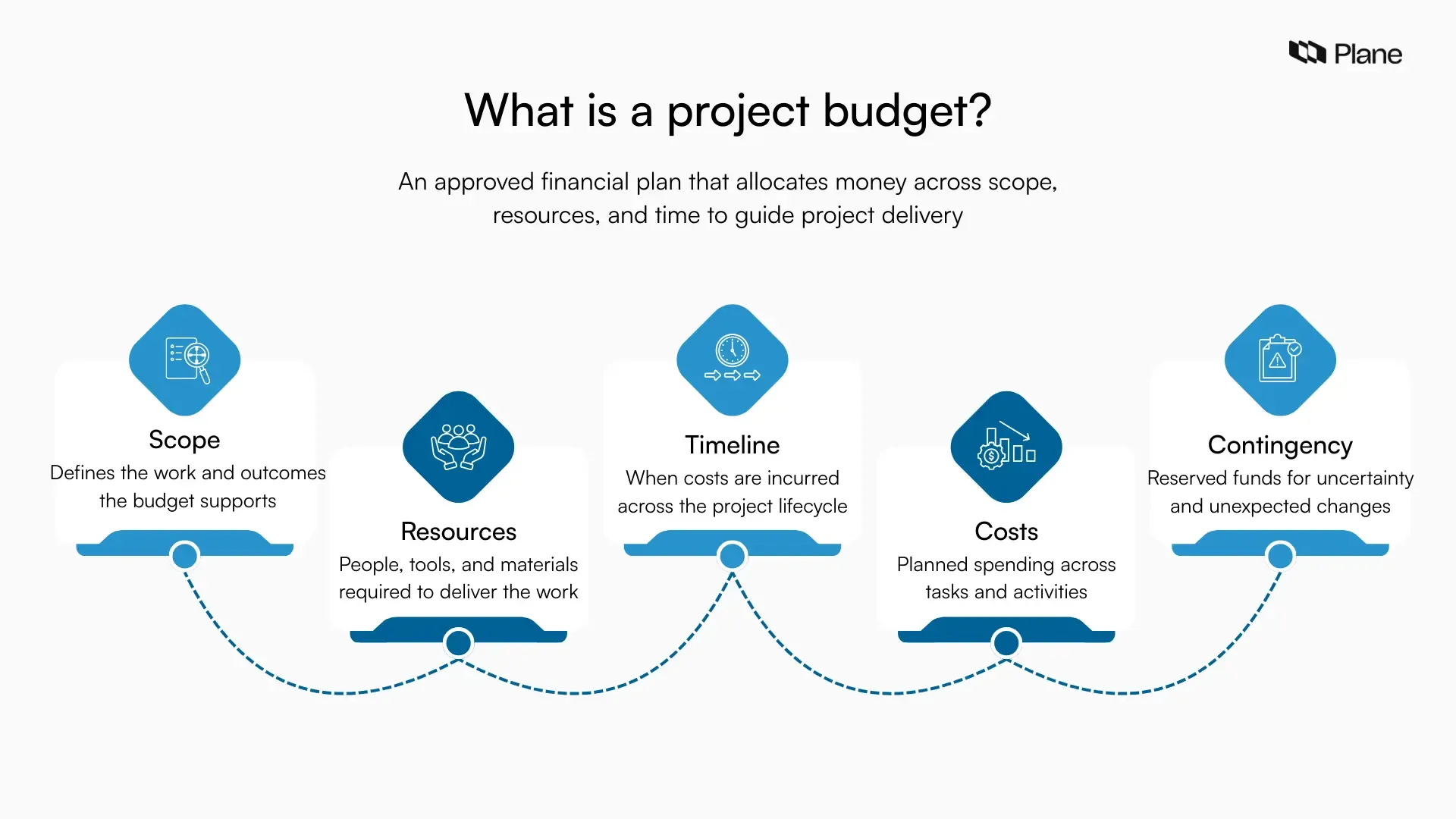

What is project budget?

A project budget is defined as a financial plan that estimates the total costs associated with a project over its entire duration.

It includes all expected expenditures, such as labor, materials, equipment, overhead, and contingency funds, necessary to achieve the project objectives. This document serves as a guideline for resource allocation and is essential for managing the project's financial health. A well-prepared budget ensures that a project remains within its financial boundaries while meeting its goals effectively.

The creation of a project budget involves identifying all tasks and activities required to complete the project and assigning monetary values to each. This process typically begins with breaking down the project into smaller components using tools like work breakdown structures. Accurate cost estimation is crucial at this stage, as errors can lead to budget overruns or resource shortages. Factors such as market conditions, supplier rates, and risk assessments are considered to provide realistic cost estimates.

Once developed, the project budget becomes a critical tool for tracking and controlling project expenditures. Project managers regularly monitor actual expenses against the budget to identify variances and take corrective actions when necessary. This monitoring ensures that the project stays on track financially, preventing disruptions or delays caused by financial mismanagement. Regular reporting also promotes transparency and accountability among stakeholders.

For example, imagine a construction project to build a community park. The project budget would include costs for land preparation, purchasing materials like benches and playground equipment, hiring contractors, and unforeseen contingencies like weather delays. If the total estimated cost is $500,000, the budget guides the allocation of funds to each activity. If unexpected expenses arise, such as equipment damage, contingency funds within the budget can address the issue without halting progress. This example highlights the importance of a well-structured budget in maintaining financial control and ensuring project success.

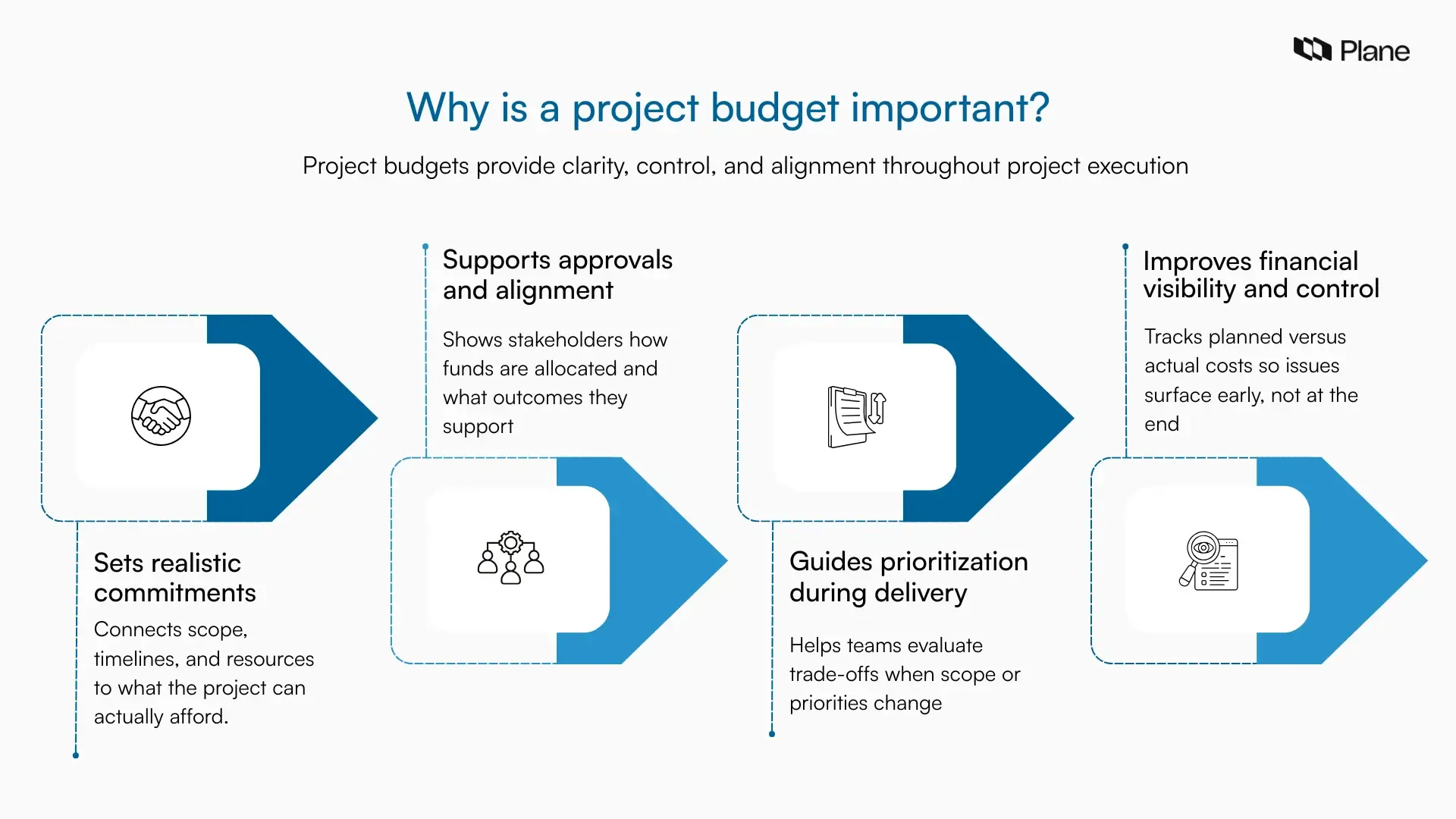

Why is a project budget important?

A project budget exists to bring clarity to decisions long before money is actually spent. It helps teams move from rough ideas to realistic execution by making costs visible early and manageable throughout the project lifecycle.

1. It turns plans into realistic commitments

Every project begins with goals, timelines, and scope. A project budget connects these plans to actual costs. It helps teams understand what work is affordable, what needs prioritization, and where trade-offs may be required. This prevents teams from committing to more work than available resources can support.

2. It supports approvals and stakeholder alignment

Budgets play a key role in securing approvals from sponsors and leadership. A clear project budget shows how money will be spent, when it will be spent, and what outcomes it supports. This builds confidence, speeds up approvals, and reduces back-and-forth during execution.

3. It enables better prioritization during execution

As projects progress, priorities often shift. A project budget provides teams with a financial reference point for evaluating changes. It helps answer practical questions such as whether adding a feature is worth the cost or whether resources should be redirected to higher-impact work.

4. It improves financial visibility and control

Project budgets provide ongoing visibility into planned versus actual spending. This visibility allows teams to identify risks early, address cost overruns before they escalate, and maintain control without slowing delivery. For project managers, budgeting becomes a tool for steady decision-making rather than a last-minute correction exercise.

Together, these benefits make project budgeting an essential part of effective project management rather than a one-time planning activity.

Key components of project Budget

The key components of a project budget include all the financial elements necessary to execute a project successfully. These components ensure that every aspect of the project is accounted for and provide a framework for effective cost management. Below are the essential components explained in detail:

1. Direct costs: These are costs directly attributable to specific project activities. For example, in a software development project, direct costs would cover developer salaries, software licenses, and testing tools.

2. Indirect costs: Indirect costs are not directly linked to the project expenses but are required for project completion. For example, utilities, administrative support, and office space etc.

3. Contingency funds: A contingency budget is set aside to address unforeseen expenses or risks that arise during the project. This component ensures that the project can handle unexpected challenges, such as delays or price fluctuations, without jeopardizing its completion.

4. Overheads: Overhead costs refer to the general and administrative expenses of the organization supporting the project. These include costs like management salaries, company insurance, and IT infrastructure. Allocating overheads appropriately ensures organizational stability while executing the project.

5. Travel and training expenses: If the project requires team members to travel or undergo specialized training, these costs must be included. For instance, international projects might involve airfare, accommodation, and training workshops.

6. Capital expenses: For projects that require significant investments in fixed assets, such as machinery or infrastructure, these are classified as capital expenses. These costs are usually one-time investments but have long-term impacts.

7. Monitoring and evaluation costs: These cover activities like performance assessments, reporting, and quality assurance checks. Including these ensures the project meets its goals within the defined scope, time, and budget.

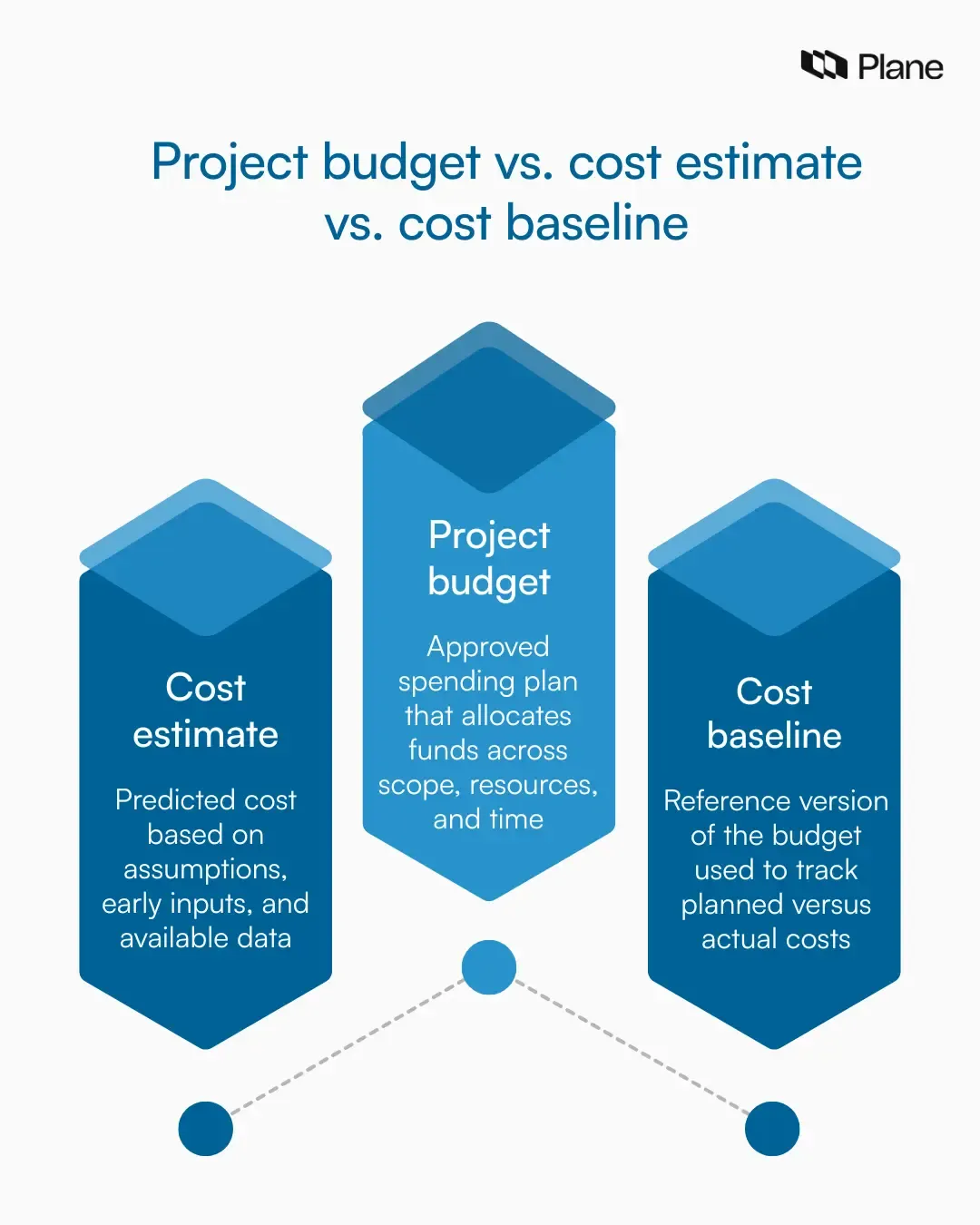

Project budget vs. cost estimate vs. cost baseline

These three terms often get used interchangeably, but they serve very different purposes in project management. Understanding the distinction helps teams plan more accurately and track costs with confidence.

1. Cost estimate

A cost estimate is a prediction of how much a project is likely to cost. It is created early, often when details are still evolving. Estimates are based on assumptions, historical data, vendor quotes, or similar past projects. Their goal is to provide a reasonable cost estimate, not a commitment.

2. Project budget

A project budget is the approved financial plan for delivering the project. It is built using cost estimates, adjusted for risks, overheads, and contingencies, and then formally approved by stakeholders. Once approved, the budget defines how much can be spent and how funds are allocated across work, resources, and time.

3. Cost baseline

A cost baseline is the version of the project budget that teams use for tracking and control. It serves as the reference point for comparing planned costs against actual spending during execution. When the scope or priorities change, the baseline may be updated to reflect new approved decisions.

Together, these elements form a progression from prediction to approval to control, giving teams financial clarity throughout the project lifecycle.

How to create a project budget: 7 key steps with examples

Creating a project budget involves a systematic approach to estimating costs, allocating resources, and preparing for contingencies. This process ensures that all financial aspects of the project are covered, supporting effective execution and minimizing financial risks. Below are the key steps to creating a project budget, along with examples for clarity:

Step 1. Define project scope and objectives

Begin by clearly outlining the project’s goals, deliverables, and scope. This helps identify all the activities and tasks necessary to complete the project. For example, in a marketing campaign project, the scope might include designing promotional materials, running digital ads, and hosting a launch event. Understanding the scope ensures all relevant costs are considered in the budget.

Step 2. Break down the project into tasks

Divide the project into smaller, manageable components using tools like a work breakdown structure. Each task or deliverable is then assigned a cost estimate. For instance, in a software development project, tasks may include coding, testing, and deployment. Assigning costs to each task ensures detailed and accurate budgeting.

Step 3. Estimate costs for each task

Estimate the costs associated with each task, considering factors like labor, materials, equipment, and other direct expenses. Use historical data, vendor quotes, or industry benchmarks for accuracy. For example, if the project involves hiring a graphic designer, the cost might include hourly rates multiplied by the estimated hours of work.

Step 4. Account for indirect costs and overheads

Include indirect costs, such as administrative expenses and overheads, to capture the total financial requirement. For example, if the project requires office space or utility usage, these costs should be distributed across the budget. Ignoring these can lead to underestimating project costs.

Step 5. Add contingency funds

Set aside a percentage of the total budget as contingency funds to handle unexpected expenses or risks. For example, if a construction project faces delays due to bad weather, contingency funds can cover additional labor or equipment rental costs. A typical contingency allocation might be 5-10% of the total budget, depending on the project's complexity and risk level.

Step 6. Review and finalize the budget

Collaborate with stakeholders to review the draft budget for completeness and accuracy. Adjust estimates based on their feedback or additional insights. For example, project sponsors might suggest reallocating resources to prioritize critical tasks, such as marketing over R&D. Finalizing the budget ensures alignment with stakeholder expectations.

Step 7. Track and update the budget regularly

Once the project is underway, regularly monitor actual expenses against the budget. Update the budget as necessary to reflect changes in scope or unexpected costs. For instance, if software licensing fees increase mid-project, adjust the budget to accommodate the new rates without disrupting other activities.

Common cost estimation approaches used in project budgeting

Teams use different estimation approaches depending on the amount of information available and the level of certainty the project requires. There is no single right method. The goal is to choose an approach that matches the project’s complexity, risk level, and planning stage.

1. Bottom-up estimation

Bottom-up estimation starts at the task level. Teams estimate the cost of individual activities and then roll them up into a total project cost. This approach works best when the scope is well defined, and teams have a clear understanding of the work involved. It is commonly used in delivery-focused projects where accuracy matters more than speed.

2. Top-down estimation

Top-down estimation begins with an overall budget limit and distributes costs across phases or work areas. Teams use this approach when early decisions need to be made quickly or when detailed task information is not yet available. It is often used during initial planning or when working within fixed funding constraints.

3. Analogous estimation

Analogous estimation relies on data from similar past projects. Teams compare the current project to previous work and adjust costs based on size, complexity, or context. This approach is useful when historical data is available, and the project shares strong similarities with earlier efforts.

4. Parametric estimation

Parametric estimation uses standard rates or unit costs to calculate expenses. For example, cost per resource hour or cost per deliverable. Teams use this method when work can be measured consistently and reliable rate data exists. It supports faster estimates with reasonable accuracy.

5. Scenario-based estimates

Scenario-based estimation explores multiple possible outcomes by creating best-case, expected, and high-cost scenarios. Teams use this approach for projects with high uncertainty or risk. It helps prepare for variability and supports more informed contingency planning.

Using the right estimation approach helps teams balance speed, accuracy, and confidence when building a project budget.

Best practices for tracking your project budget

Tracking a project budget effectively is essential for ensuring financial control and achieving project objectives. It involves monitoring expenses, identifying variances, and making adjustments as needed to keep the project on track. Below are some best practices for tracking a project budget:

1. Use a detailed baseline budget

Start with a well-prepared baseline budget that outlines all estimated costs and allocations. This serves as a reference point for tracking actual expenses. For example, if a construction project allocates $100,000 for materials, the baseline helps compare this amount to actual material costs incurred.

2. Implement a robust tracking system

Utilize project management software like Plane.so to monitor expenses in real time. For example, a software development team might use cost tracking features in Jira to monitor task-specific expenses.

3. Categorize and track expenses regularly

Organize project costs into categories and monitor these categories frequently, such as weekly or bi-weekly, to detect discrepancies early. For instance, if labor costs are rising faster than anticipated, regular tracking helps identify the issue before it escalates.

4. Compare actual costs to the budget

Regularly compare actual expenses to the planned budget to identify variances. Use variance analysis to determine whether differences are due to scope changes, inefficiencies, or unforeseen factors. For example, if travel costs exceed the budget, a variance analysis might reveal that unexpected international travel was required.

5. Involve stakeholders in financial reviews

Hold regular financial review meetings with key stakeholders to share budget updates, address concerns, and align on corrective actions. For example, if a marketing project experiences cost overruns on ad spend, the team might adjust by reallocating funds from lower-priority activities.

6. Adjust for scope changes and risks

Update the budget as necessary to reflect changes in project scope or unforeseen risks. For example, if a manufacturing project introduces a new product line mid-project, the budget should be revised to accommodate additional resources and materials.

7. Maintain a contingency reserve

Track the use of contingency funds separately to ensure they are only used for genuine unforeseen circumstances. This helps maintain financial discipline. For instance, a software development project might use contingency funds to address an unexpected cybersecurity issue.

8. Document and analyze variances

Keep a detailed record of all budget variances and their causes. Use this information to improve future budgeting processes. For example, if equipment costs were underestimated in one project, the insights can guide more accurate estimates in subsequent projects.

9. Leverage automation for accuracy

Automate repetitive tracking tasks, such as invoice matching or expense reporting, to reduce errors and save time. For instance, using automated expense tracking software can link invoices to specific budget categories, ensuring real-time accuracy.

Budget variance: Planned vs actual costs

Once a project budget is approved, teams need a clear way to determine whether spending stays on track. Budget variance provides that clarity by showing the difference between what was planned and what actually happened.

What does a budget variance mean?

Budget variance is the difference between the planned cost and the actual cost of work completed. It highlights whether a project is spending more or less than expected at any point in time. This makes it easier to spot risks early rather than at the end of the project.

A simple budget variance formula

Budget variance can be calculated using a straightforward comparison:

Budget variance = planned cost − actual cost

This calculation focuses on understanding direction and magnitude rather than financial complexity.

Positive vs negative variance

A positive variance indicates that actual spending is lower than planned, which often means the project is under budget. A negative variance indicates that actual costs exceed planned costs, signaling a potential overrun. Both outcomes require context, since being under budget may also reflect delayed work or missed scope.

When teams should act on variance

Teams should review variance regularly and act when trends appear rather than waiting for large gaps to form. Small variances can signal emerging issues with estimates, scope changes, or resource usage. Addressing these early helps teams adjust plans, reallocate resources, or update the budget before costs escalate.

Used consistently, budget variance becomes a practical control tool rather than a reactive financial check.

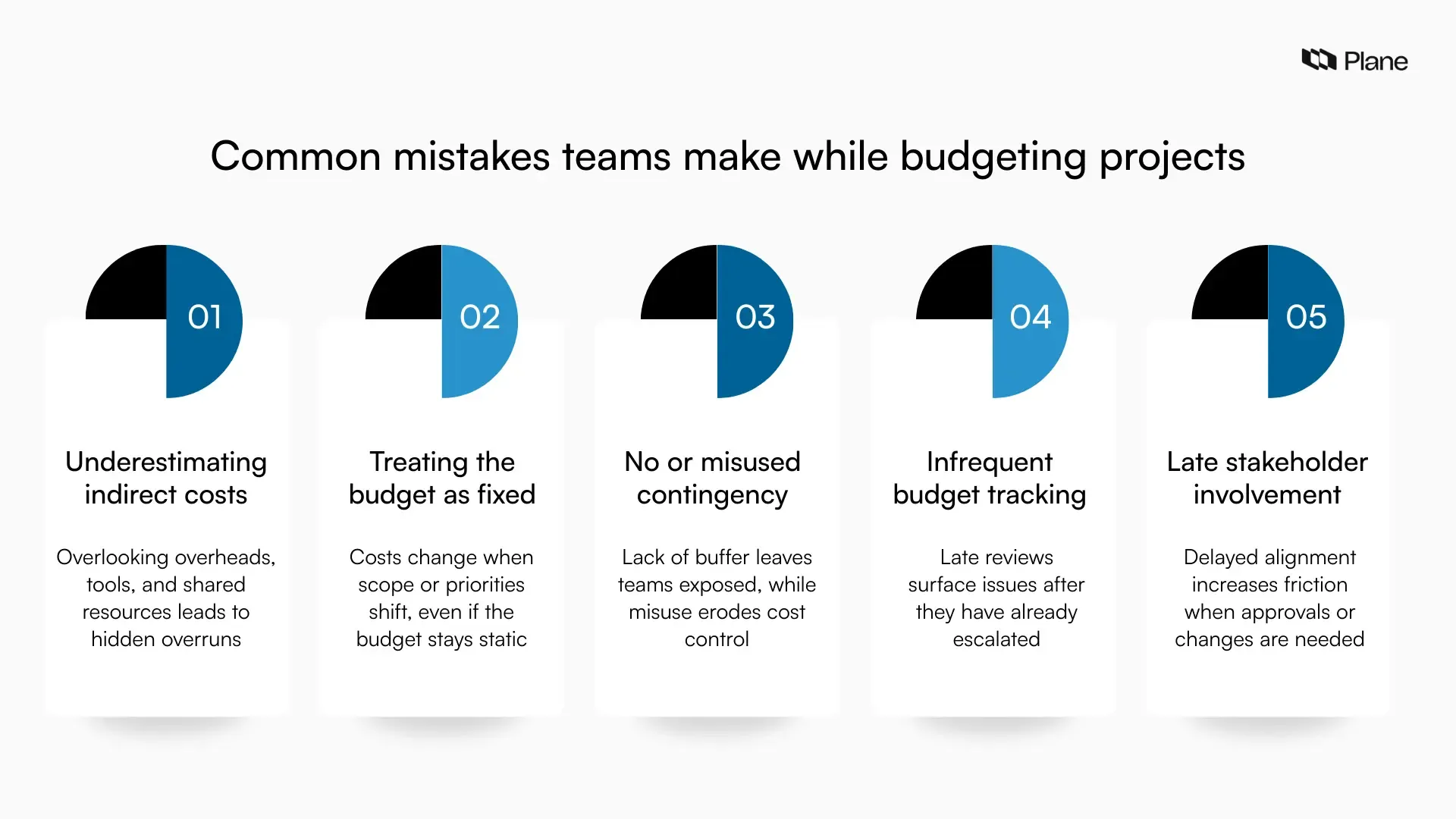

Common mistakes teams make while budgeting projects

Many project budget issues stem from process gaps rather than poor math. These mistakes tend to surface when budgeting is treated as a formality instead of an ongoing management practice.

1. Underestimating indirect or overhead costs

Teams often focus on visible costs such as labor and materials while overlooking indirect expenses. Administrative support, tools, shared infrastructure, and operational overheads add up over time. When these costs are not accounted for early, budgets appear accurate on paper but fail during execution.

2. Treating the budget as fixed despite scope changes

Project scope rarely stays static. New requirements, revised timelines, or resource changes all affect costs. Treating the original budget as untouchable creates misalignment between plans and reality. Effective teams revisit and adjust budgets when approved changes occur, keeping financial expectations realistic.

3. No contingency or misuse of contingency

Some projects skip contingency planning altogether, while others treat contingency funds as extra spending room. Contingency exists to absorb genuine uncertainty, not planned work. Without clear rules for its use, teams either run out of buffer too early or lose control over costs.

4. Poor tracking cadence

Tracking budgets too infrequently delays visibility into cost issues. Monthly or end-of-phase reviews often surface problems after they have already grown. Regular tracking helps teams spot trends early and make smaller, easier corrections.

5. Late stakeholder involvement

When stakeholders are only involved during final reviews, budget decisions lose context. Early and ongoing involvement ensures alignment on priorities, trade-offs, and financial constraints. This reduces friction when changes or approvals are needed later in the project.

Avoiding these mistakes helps teams maintain control, transparency, and confidence throughout the project lifecycle.

Closing thoughts

Project budgets work best when they are treated as evolving tools rather than static plans. As scope, timelines, and priorities shift, budgets need to reflect those changes with clarity and intent. The value of project budgeting lies in maintaining visibility and control throughout delivery, not in predicting every cost upfront. When teams use budgets to guide decisions, evaluate trade-offs, and respond to change early, they create stronger alignment between plans and execution. In practice, effective project budgeting supports better outcomes by enabling informed decisions at every stage of the project, rather than focusing solely on staying within a fixed number.

Frequently asked questions

Q1. What do you mean by project budget?

A project budget is an approved financial plan that outlines how much money can be spent to deliver a project. It covers all expected costs such as resources, materials, tools, overheads, and contingency, and serves as the reference for tracking and controlling spending during execution.

Q2. How do you write a budget for a project?

Writing a project budget starts with defining the project scope and breaking work into tasks. Teams then estimate costs for resources, materials, and indirect expenses, add contingency for risk, review assumptions with stakeholders, and finalize the budget for approval. Once approved, the budget is tracked and updated as the project progresses.

Q3. What are the four types of budget?

Common budget types used in projects include fixed, flexible, incremental, and zero-based. Each type is chosen based on the predictability of the work, how funding is allocated, and how much flexibility the project requires during execution.

Q4. What are the seven steps to budgeting?

The typical steps include defining scope, breaking work into tasks, estimating task-level costs, accounting for indirect and overhead costs, adding contingency, reviewing and approving the budget, and tracking actual costs against the plan throughout the project lifecycle.

Q5. What are the four components of a budget?

At a high level, a project budget includes direct costs, indirect costs, contingency reserves, and overhead expenses. Together, these components ensure that both visible and less obvious costs are accounted for when planning and managing the project.

Recommended for you